An interest rate rise will bite the hardest in Sydney and Melbourne’s outer suburbs as the fastest inflation in two decades sparks mounting speculation the Reserve Bank will lift rates as early as next week.

The RBA is now expected to raise the nation’s cash rate on May 3 after new data showed the consumer price index climbing by 5.1 per cent in the year to March.

The price of everyday goods and transport soared to the highest level since June 2001, a year after the GST was introduced.

ANZ and Westpac are now expecting a rate rise next week – the first in almost 12 years.

Even a small 0.15 percentage point increase in the RBA cash rate on Tuesday – taking it to 0.25 per cent from a record-low of 0.1 per cent – would add $47 a month to repayments on a typical $600,000 Australian home loan.

But a possibly larger 0.4 percentage point increase next week or in June would see those repayments suddenly spike by $125.

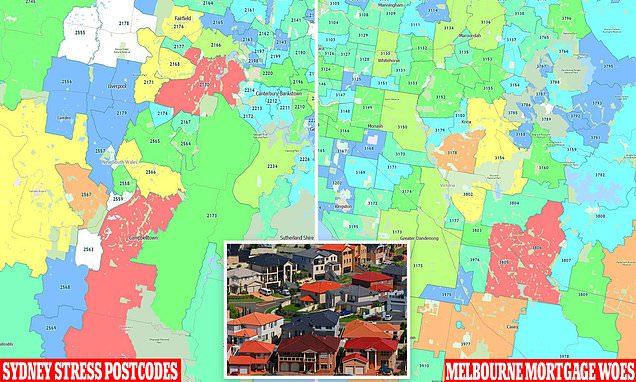

Sydney’s outer suburbs are home to four of Australia’s five worst areas for mortgage stress, with Melbourne having one spot on this list where more than 70 per cent of borrowers are really struggling even with interest rates still at record lows.

Mortgage stress is expected to bite harder in outer suburban areas as the fastest inflation since the introduction of the GST two decades ago sparks an early rate rise (pictured are houses at Cecil Hills in Sydney’s south-west in the mortgage stress electorate of Werriwa)

The Reserve Bank is now expected to raise the nation’s cash rate on May 3 after new data showed the consumer price index climbing by 5.1 per cent in the year to March. The price of everyday goods and transport soared to the highest level since June 2001, a year after the GST was introduced (pictured is an auction at Glen Iris in Melbourne)

Mortgage stress postcodes CAMPBELLTOWN, LEUMEAH: 2560

CASULA, LIVERPOOL: 2170

NARRE WARREN: 3805

BERWICK, HARKAWAY: 3806

NARELLAN, MOUNT ANNAN: 2567

PACKENHAM: 3810

CARDINIA: 3978

CRANBOURNE: 3977

In Australia’s biggest cities, borrowers typically have much bigger mortgages following huge surges in house prices, putting particular stress on middle and average-income earners.

Digital Finance Analytics principal Martin North said weak wages growth meant borrowers with little savings would get squeezed.

‘High debt thanks to high prices and big mortgages, plus raging consumer prices and no income growth, and some still underemployed,’ he told Daily Mail Australia. ‘Perfect cocktail.

‘They will be at the epicentre of stress ahead.’

Sydney’s outer south-west, more than 60km from the city centre, is particularly at risk, data from the University of New South Wales City Futures Research Centre and Digital Finance Analytics showed.

The federal Labor electorate of Macarthur is vulnerable with 76.49 per cent of borrowers in mortgage stress where any rate rise would affect their ability to pay their bills.

The areas covers Campbelltown where the median house price of $797,877, as measured by CoreLogic, is so high an average, full-time work earning $90,917 a year would have a debt-to-income ratio of ‘seven’ after a 20 per cent mortgage deposit.

The Australian Prudential Regulation Authority, the banking regulator, considers a debt threshold of ‘six’ to be particularly risky.

Household incomes in this area are higher than the national average.

The federal Labor electorate of Macarthur is vulnerable with 76.49 per cent of borrowers in mortgage stress where any rate rise would affect their ability to pay their bills. The areas covers Campbelltown where the median house price of $797,877, as measured by CoreLogic

But many borrowers in this area earn far less than the national average salary, which means any rate rise will stretch their household finances.

In the neighbouring Labor electorate of Werriwa, 70.72 per cent of borrowers are in mortgage stress.

The seat takes in Casula, where the median house price is now $1.073million.

While that’s lower than greater Sydney’s $1.403million mid-point, a borrower with a 20 per cent deposit buying in that suburb would need to earn $143,102 a year just to avoid being in mortgage stress.

An average, full-time worker would have a debt-to-income ratio of 9.4 and would be unable to borrower unless their spouse worked too.

In nearby Fowler, where senator and former NSW premier Kristina Keneally is the Labor candidate, 70.04 per cent of borrowers are in mortgage stress in an area where Cabramatta’s median house price is now $1.052million.

Further down the Hume Highway, 71.6 per cent of borrowers are in mortgage stress in the safe Liberal electorate of Hume, held by Energy Minister Angus Taylor.

The seat includes the provincial city of Goulburn where $595,973 is the median house price.

Melbourne has one spot on the mortgage stress list with 72.28 per cent voters in the marginal, Liberal-held seat of La Trobe in mortgage stress. The area includes Upper Beaconsfield where the median house price of $1.396million would see an average-income earner have a very debt-to-income ratio of 12.3 after a 20 per cent mortgage deposit.

Mortgage stress levels by electorates MACARTHUR, Sydney outer south-west (safe Labor): 76.49 per cent

LA TROBE, Melbourne outer south-east (marginal Liberal): 72.28 per cent

HUME, Sydney outer south-west and southern NSW (safe Liberal): 71.6 per cent

WERRIWA, Sydney south-west (marginal Labor): 70.72 per cent

FOWLER, Sydney south-west (safe Labor): 70.04 per cent

An average-income worker would have a debt-to-income ratio of 5.2 after a 20 per cent deposit.

But at the other end of the electorate, the median house price at Appin is $1.078million which means an average-income earner with a 20 per cent deposit would have a dangerous debt-to-income ratio of 9.5.

Melbourne has one spot on the mortgage stress list with 72.28 per cent of borrowers in mortgage stress in the marginal, Liberal-held seat of La Trobe.

Berwick is particularly at risk in a suburb where $939,064 is the middle house price.

The electorate also includes Beaconsfield Upper where the median house price of $1.396million would see an average-income earner have a very debt-to-income ratio of 12.3 after a 20 per cent mortgage deposit.

A couple, with both working full-time on average salaries, would struggle to service that kind of $1.116million mortgage.

Before the Australian Bureau of Statistics on Wednesday released inflation data for the March quarter, the big banks were all expecting a rate rise in June, which would be the first since November 2010.

But ANZ was the first big bank to declare the RBA would raise rates by 0.15 percentage points in May.

Westpac on Thursday joined in, with chief economist Bill Evans now also predicting a May rate rise of 0.15 percentage points.

‘Last week we predicted a “jumbo” 40 basis point lift in the cash rate in June in response to a significant lift in the expected print for underlying inflation,’ he said.

‘The actual lift was even more than we expected and makes the case for an immediate move of 15 basis points next week.’

This would be the first increase during an election campaign since November 2007, which saw Liberal prime minister John Howard lose.

A 15 basis point rise would see monthly repayments on a typical $600,000 mortgage rise by $47 to $2,353, should a borrower see their variable rate rise from 2.29 per cent to 2.44 per cent in line with an RBA move.

Before the Australian Bureau of Statistics on Wednesday released inflation data for the March quarter, the big banks were all expecting a rate rise in June, which would be the first since November 2010. But ANZ was the first big bank to declare the RBA would raise rates by 0.15 percentage points in May

Mr North said the RBA would raise rates on Tuesday next week if it cared more about tackling inflation than politics.

‘The case for a rate rise from the RBA is very strong, if they are non-political they will lift in May, ideally to 0.5 per cent, but if they don’t we can conclude they will lift in June, by the same amount, and that they are politically influenced,’ he said.

‘This would be the first of several rate rises in the months ahead.’

A 0.4 percentage point increase, in either May or June, would see monthly repayments on a $600,000 loan climb by $125 to $2,431 as a typical variable rate climbed to 2.69 per cent.

Kate Colvin, the spokeswoman for social housing advocacy group Everybody’s Home, said rising interest rates would add to housing stress and homelessness.

‘Australians across the country from the regions to our biggest cities are already at breaking point, no part of the country has been spared,’ she said.

Australia’s inflation soars to 21-year high Consumer price index in the year to March climbed by 5.1 per cent

Fastest headline inflation since the 6.1 per cent annual increase in June 2001 following GST introduction

Level well above Reserve Bank of Australia’s 2 to 3 per cent target

Economists expecting May rate rise – first during election campaign since November 2007

Petrol prices have increased by 11 per cent in a year – fastest annual increase since 1990 when Iraq invaded Kuwait

Underlying inflation without high petrol prices at 3.7 per cent – highest since 2009