LIC’s IPO, which had beforehand been touted as India’s Aramco 2nd in reference to the $29.4 billion list of Gulf oil huge Saudi Arabian Oil Co., is discovering out the depth of India’s capital market.

India’s greatest ever public providing drew anchor investors along side Norway’s sovereign wealth fund and the Singaporean authorities, elevating 56.3 billion rupees ($736 million) sooner than its plump initial public providing.

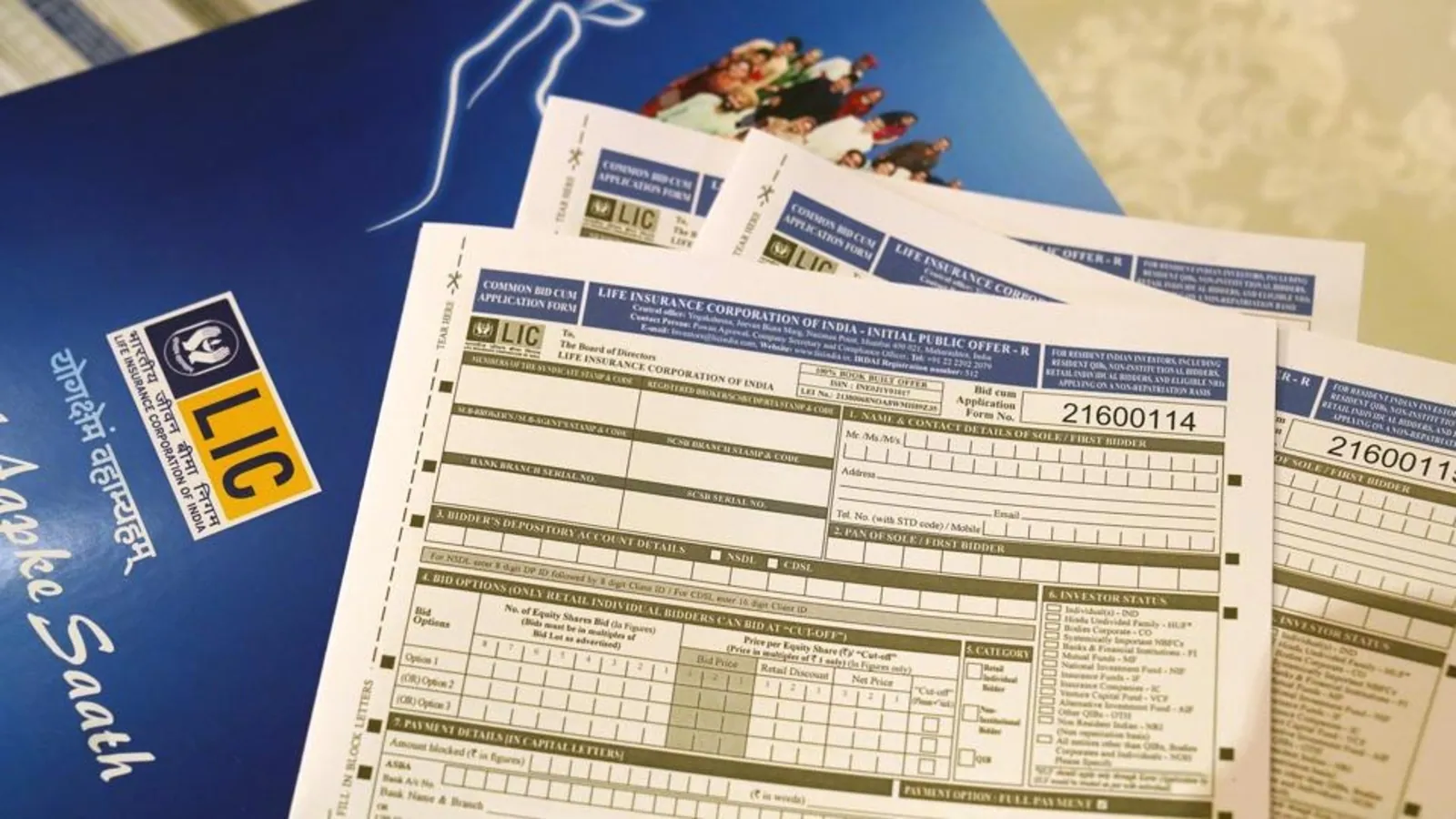

The 123 anchor investors joining Lifestyles Insurance coverage Corp. of India’s IPO dedicated to remove shares at 949 rupees every, the tip break of a marketed range, per a stock alternate assertion Tuesday. They encompass the Norwegian fund and the Singapore authorities, confirming an earlier memoir by Bloomberg Recordsdata, as neatly as 15 domestic mutual funds accounting for 71% of the anchor allocation. Orders from retail investors for the list, which can maybe elevate as grand as 210 billion rupees in total, shall be taken beginning Wednesday.

LIC’s IPO, which had beforehand been touted as India’s Aramco 2nd in reference to the $29.4 billion list of Gulf oil huge Saudi Arabian Oil Co., is discovering out the depth of India’s capital market. Whereas India’s authorities has pared abet its normal fundraising purpose by about 60% — as the warfare in Ukraine eroded investor fling for food — the providing will clean be the nation’s greatest.

Based in the gradual 1950s, LIC is the nation’s oldest insurer, and had the market to itself till the authorities opened it up to inner most opponents in 2000. It remains India’s greatest insurer with a sales agent in practically every neighborhood all the procedure during the nation of about 1.4 billion folk. The list is predicted to entice minute-city retail investors and right policyholders with an emotional attachment to the firm.

LIC has a 60% market fragment of India’s 24-firm-unprecedented existence insurance market, however its relieve is fearful as inner most players love HDFC Lifestyles Insurance coverage Co. and SBI Lifestyles Insurance coverage Co. chip away at its dominance. The inner most sector has been on an aggressive expansion spree all the procedure during the Covid-19 pandemic, growing fresh particular particular person policy premiums while LIC struggles.

Subscribe to our most effective newsletters

Shut Narrative