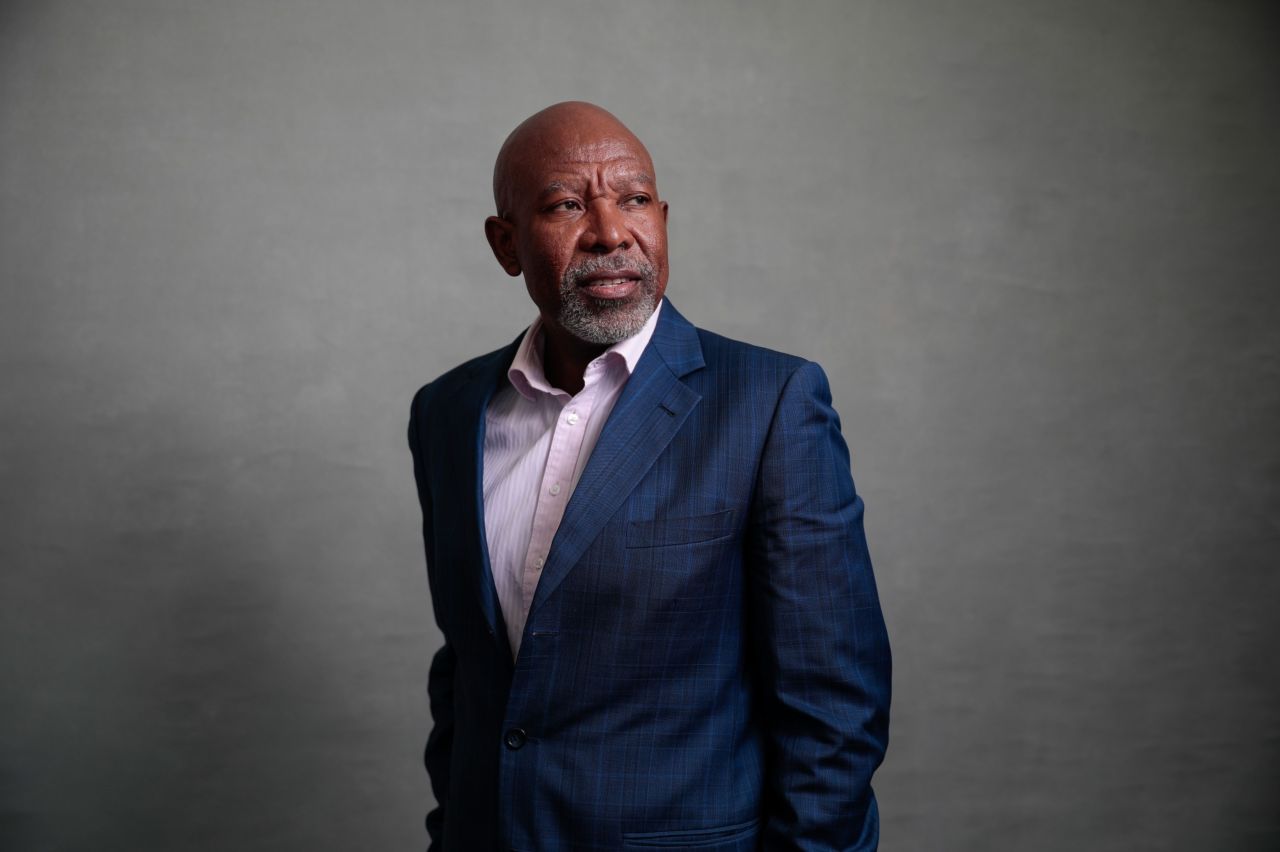

Lesetja Kganyago, governor of South Africa’s reserve bank, poses for a insist following a Bloomberg Tv interview on the gap day of the World Economic Forum (WEF) in Davos, Switzerland, on Tuesday, Jan. 21, 2020. World leaders, influential executives, bankers and policy makers encourage the 50th annual assembly of the World Economic Forum in Davos from Jan. 21 – 24.

Annual inflation that surged above the Reserve Monetary institution’s target differ for the first time in greater than five years in Might had moved merchants to brand in as a minimal one 75-foundation-point win bigger this year. A three-quarter share point hike could be the largest since September 2002, when the bank lifted the benchmark rate by 100 foundation points.

Sooner than the brand shock, the implied policy rate direction of its quarterly projection model, which the financial policy committee makes consume of as a recordsdata, indicated the key rate will be at 5.3% by year-quit. While the central bank’s baseline scenario for increases of 25 foundation points at every of its subsequent three meetings remains, the different of lifting the repurchase rate by 50 foundation points subsequent month is “now not off the desk,” Governor Lesetja Kganyago said in an interview with Bloomberg TV on the sidelines of the European Central Monetary institution’s annual policy dialogue board in Sintra, Portugal.

Forward-rate agreements, frail to speculate on borrowing costs, are now pricing in about 50 foundation points of tightening at the following MPC assembly scheduled for July 21. That compares with 63 foundation points prior to Kganyago’s feedback. The market anticipates 175 foundation points of hikes in complete by year-quit.

The annual inflation rate climbed to 6.5% in Might, in contrast with the central bank’s estimate of 6.3%, Kganyago said. The Reserve Monetary institution prefers to anchor inflation expectations near the midpoint of its 3% to 6% target differ and has raised the key rate by a cumulative 125 foundation points to 4.75% since November.

While the MPC seeks to ogle beyond instant-timeframe brand shocks, it’ll’t expect “concrete evidence that 2d-round effects are kicking in” in an dangerous ambiance, he said. It’s “going to prefer to procure a scrutinize about the prospect of 2d-round effects kicking in and thus acting.”

Aggressive upward moves can also aloof help prop up a native forex that’s weakened for the reason that Fed delivered it largest hobby-rate win bigger since 2000 and anchor home inflation expectations.

Light, the unwinding of unparalleled pandemic-era financial policy stimulus measures have a tendency to design criticism from some politicians and labor unions amid a deterioration in home financial prospects and fears of a brand-of-residing crisis.

“We don’t even peek it a lot as a slamming of the brakes,” Kganyago said. “It’s more fancy taking your foot off the accelerator than slamming on the brakes.”

In Might, the central bank decrease its 2022 financial progress forecast for South Africa to 1.7% from 2%. That’s after lethal floods wreaked havoc in KwaZulu-Natal province, the 2d-largest contributor to atrocious home product. It’s more seemingly to decrease its projection even extra after command-owned power utility Eskom Holdings SOC Ltd., which generates nearly all of the country’s electricity, deepened power cuts to the worst level since 2019.