KarmaLife, a financial alternate choices provider for Gig & Blue-collar staff and LEAD at Krea College on Friday, July 1, released a chronicle titled GigPulse, to shine a gradual-weight on the day-to-day work and financial lives of the Gig Workers.

The chronicle discovered that 22 per cent of gig staff are most important earners who enhance their families and resolve gig work as a supply of livelihood, whereas 39 per cent are intrepid financial planners who co-develop with their other household participants and look this work as a non everlasting transition to a ‘higher opportunity’. The comfort are dependents and not utilizing a-to-low duties who look gig work as a potential to develop more cash.

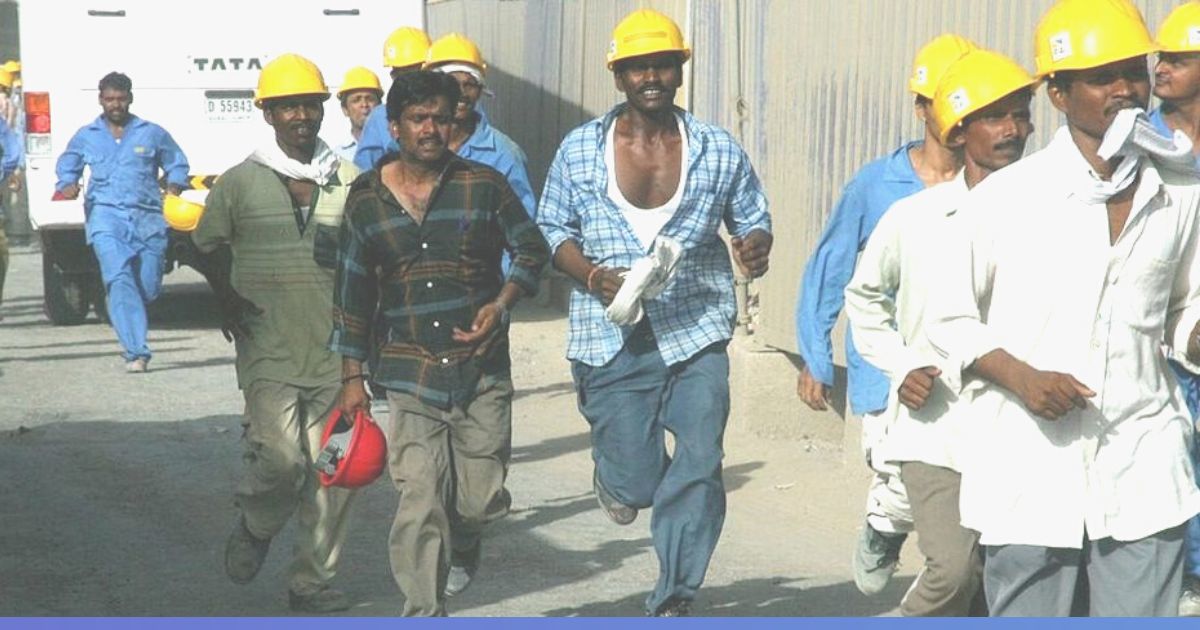

The latest chronicle is basically basically based entirely on a detailed glimpse of over 500 energetic gig staff across sectors – in conjunction with hyperlocal and city logistics, e-commerce logistics, flexi-staffing, food services and products, and FoS sales, who utilize KarmaLife’s platform.

In response to the glimpse, Gig staff are younger with a median age of 27, amongst which 37 per cent are married, 29 per cent have kids, 28 per cent are migrants, and 60 per cent are motivated to work to enhance their families. On the other hand, 18 per cent claim gig work helps them develop extra pocket cash.

Gig Workers Watch Job Security And Flexible HoursJob security, pay levels and flexible hours are the discontinuance three ranked attributes gig staff glimpse from their work environment. Relating to most important lifestyles targets, 29 per cent aspire to be self-reliant, 27 per cent of staff must reach career success and 25 per cent aspire to approach their household’s future.

As well, the chronicle acknowledged that as regards to 80 per cent of gig staff chronicle on-the-job studying of ‘commended skills’ even supposing it is unclear to what extent it would perchance perhaps perhaps support them development of their careers.

Sensible gig worker earnings are approximately ₹18000 per month, with ‘assured pay’ items compensating higher on moderate than extra flexible ‘pay-per-process’ items. Relating to expenditure, most staff chronicle hand-to-mouth price range, with a valuable a part of earnings centered on necessities (groceries, hire) and working assets (cellular, vehicle upkeep).

Mix Of Surpluses And DeficitsGig staff across varied segments reported a combine of surpluses and deficits in any month, indicating they are able to have the profit of entry to flexible liquidity and liquid savings alternate choices. In a given month, bigger than 15 per cent of staff faced a financial deficit of ₹5000 on moderate. In conserving with the glimpse, over 80 per cent of these staff reach no longer have a bank card facility, of which around two-thirds feel the necessity.

Around 6.6 per cent have latest or prominent loans, 11.5 per cent have energetic EMIs, and 26.3 per cent borrow from colleagues they work with. The chronicle suggests very best 25 per cent can keep ceaselessly-kid’s training and clinical emergencies are valuable reasons cited.

“Right here’s a time-important initiative to fetch granular insights and kind a info-backed story on the lives of a key crew section in India. There would possibly perhaps be too scarce info on worker identities, needs and aspirations, household context, financial behaviours, work patterns and resilience mechanisms. Through this partnership with LEAD, we hope to make a properly off longitudinal info asset that would perchance perhaps support the ecosystem largely,” acknowledged Rohit Rathi, Co-founder & CEO, KarmaLife.

Govt Director of LEAD at Krea College, Sharon Buteau, echoed, “We are enraged to be participating with industry-centered gamers to generate unique intelligence on considered one of many fastest-rising but most prone worker segments. We salvage this relevant as India is on the cusp of imposing a brand unique social security code that bestows first-time recognition to gig staff and promises them deeper social protection.”

Despite the perceived financial vulnerability to contingencies that also can abate earning continuity, nearly 20 per cent of gig staff check up on insurance as a viable approach. As well, 27 per cent self-consume insurance, whereas 43 per cent reach no longer have any insurance. On the other hand, 49 per cent acknowledged COVID-19 has made them rethink their insurance choices. While a majority salvage accidental insurance from employers, lower than three per cent salvage any pension benefits.

This emerging section is mandatory to a flourishing labour power in India, to extra support them develop, they require an enabling ecosystem to enhance them and present alternate choices to support them be extra financially resilient, as properly as other facets akin to strengthening their career trajectory through upskilling and practising.

Additionally Read: Mumbai: Eknath Shinde-Led Maharashtra Govt To Carry Support Metro Car Shed Support To Aarey