Natarajan S

Please read through this – but don’t be scared if you bought in the last 7 years and totally affected by the situation prevailing. Even in times of crisis there are many solutions. I will give you solutions that I know of, for you to survive in any kind of situation.

Can real estate rebound in 2023? If at all it can rebound, when can it be? Or will there be bloodshed?

With interest rates rise for 8 times in succession there is nowhere to hide for property owners. For one third of borrowers in the last few years, the honeymoon rate and Fixed rate are coming to an end, and they are thrown out in wild west in the freezing cold of rising variable rates. Also, there is this problem of declining property prices. The owners are losing value of the property as never seen before. Is it the crash of property market that many were forecasting for many years.

As statistics from Corlogic today says, Parramatta in Sydney’s west had a 20 per cent loss rate for those owners who bought with a median hold period of six years and nine months, with sellers typically losing $49,360 after offloading properties.

This was much higher than greater Sydney’s average loss rate of 7.8 per cent – the highest level in three years.

Unit sellers in Sydney are much more likely to make a loss, with 13.1 per cent of people in this situation, compared with 1.8 per cent of house sellers.

Where sellers are making a loss

MELBOURNE CITY: 39 per cent of sales

STONNINGTON, Melbourne inner east: 27.8 per cent of sales

PARRAMATTA, Sydney’s west: 20 per cent of sales

DARWIN: 35 per cent of sales but 48.2 per cent of apartments

In the nearby Stonnington council area – covering Prahran, Toorak and Glen Iris in Melbourne’s inner east – 27.8 per cent of sales were loss-making, with sellers typically losing $62,500 after eight years as an owner.

MELBOURNE CITY: 39 per cent of sales

In the Melbourne council area – covering Docklands and Carlton – 39 per cent of homes sold for a loss in the September quarter, with vendors losing a median amount of $55,000 after a typical holding period of eight years and four months.

Melbourne unit owners were much more likely to make a loss, with 15.7 per cent selling for less than they paid, compared with just 1.1 per cent of house sellers.

Parramatta in Sydney’s west had a 20 per cent loss rate, with sellers typically losing $49,360 after offloading properties with a median hold period of six years and nine months.

This was much higher than greater Sydney’s average loss rate of 7.8 per cent – the highest level in three years.

Unit sellers in Sydney are much more likely to make a loss, with 13.1 per cent of people in this situation, compared with 1.8 per cent of house sellers.

Darwin was pretty bad with 35 per cent of sales at a loss, with home owners losing $65,000 after holding the property for nine years and six months.

In the Northern Territory capital, almost half or 48.2 per cent of apartment sellers made a loss, compared with 16 per cent of house sellers.

In Perth, 34.1 per cent of units sold at a loss, compared with 7.5 per cent of houses.

Those who bought in the last 7 years are somehow losing some amount or the other.

2023 is starting as a bloodshed year – Fixed mortgage rates go out for owners which results in owners facing 50 to 75% increase in mortgage repayments – if they can’t pay that kind of mortgage repayments every week or month, – they would try to sell at heavy loss, only if they got equity to cover the losses. If they don’t have adequate equity, then banks will auction and the loss of 100,000 or even millions NEED TO BE paid by the borrowers immediately- and it can be negotiated as private loan and monthly deductions may start immediately from their salaries. Erstwhile home owners not only lose their deposit, but also, they lose their houses. The worst part is, even if they sold the property in forced sale by Banker, their loan obligation still doesn’t go away. They lost house, they lost deposit and still they will be indebted to banks with huge monthly repayments like a slave. The other option for them is to apply for bankruptcy. For bankrupt person their finances will be managed by administrators, till paying off the debt after negotiating.

The problem was created by the greed of stake holders in Banks, Finance brokers, Real estate firms, Investors, Homeowners, etc. The real estate buying, and selling was converted into top Australian gambling and that was betting on ever increasing house price rise, that is not true real estate market. This whole market had one consumer that is tenant. Normally a consumer is given lot of options. But the business cartel as mentioned above are joining together in exploiting the renters. In any other sector this is forbidden practice. But in real estate Governments allowed this to happen.

This I have been telling and writing consistently for the last 20 years. in Australia and New zealand I demonstrated that buying any many houses is just a game but the part I disliked was when renting it out, we need to squeeze the tenants. As the houses are meant for people to live in, and this ownership gamble is too hyped towards price rise, and ever-increasing rent, (All commodity prices by competition come down but rents alone are artificially kept on increasing by the cartel like structures) to answer my heart felt conscience I didn’t want to go further on my demonstration. I started demonstration by taking on lease some old houses that are under development application, so the owner and councils have no concern whatever temporarily done there. I did some temporary adjustments to accommodate to new immigrants, students, new work starters, etc. for cheap rent.

Coming back to the basics of real estate investing, in 2007-08 Financial crisis, some States fared better than other states. That was the divide created by one big financial product, the non-recourse loans. The states of Alaska, Arizona, Washington, Utah, Idaho, Minnesota, California, North Carolina, Connecticut, North Dakota, Texas and Oregon, they have financial product called non-recourse loans. In A non-recourse loan, the lender can seize only the collateral specified in the loan agreement, even if its value does not cover the entire debt. On the other hand, the normal loan that Australia, New Zealand and other States have Recourse loan which allows a lender to pursue additional assets when a borrower defaults on a loan if the debt’s balance surpasses the collateral’s value. During Financial Crisis the non-course state borrowers when property prices were falling below the mortgage value – they were starting to just to go to the banker to hand over the key to the property so that they could walk away from their debts. But in other states it was not possible, defaulted loans had the process of notices, recovery of loan amount by auctioning/forced sale of property, court writing that balance amount on the books of the borrowers to pay, eventually borrowers filing for bankruptcy, etc. That is a tedious process for all concerned and it is bereft of any mercy and hard-core oppression of erst-while customers by bankers.

In this context we have to look back how high interest regimes worked in the past: I found an apartment after months of research on cheap property in very good place in Chennai, India, the year may be in 1995. The yet to be completed apartment was priced 100,000 by the developer. HDFC said they can give us up to 70,000 on that property in stages matching construction phase based on our annual salaries of 50,000. Why was the eligibility so low? Because the interest rate at that time was 18% plus another 1% for something totaling 19%. You look at our contribution – we needed to put our 30,000. That means we are on 30% equity loan. At those times, the other banks would not process loans that quickly and that methodically that too on yet to be constructed properties. only HDFC was so efficient, but the interest rate was higher than other banks. If you calculate our total repayments for 30 years our monthly repayment was 1112 per month and we would have paid a whooping interest of 330,400 plus 70000 = 400000 in those 30 years. For 70k loan paying 400k was norm at those times.

Banking and financial and real estate systems think in their own ways and collaborate in providing solution to buy homes – But the combination of profit oriented, interest charging strategy has its own pitfalls. The Government try to maintain competition as the mode of correcting the price for the benefit of common man. This competition worked in all other industries well. The cloth prices came down; food prices came down; travel costs came down – all because of competition. Because the Govt is clear about who the consumer is and who the provider is. But in real estate the roles are too tricky that govts can’t clearly define. The State Government when they get money through property transactions as stamp duties, they lack competition, so consumer has to deal with a monopolistic player in States and Councils. Councils dictate plans and building of projects, houses, apartments etc. Councils’ major revenue is also rates charged from properties. Their interest is better served in increasing property values, they don’t have a plan for decreasing property markets. Australian States, mainly to safeguard the stamp duty revenue in property transactions, enact laws to control how vendor need to write and give a contract even before vendor puts up the property for sale. This particular law, whatsoever be the reason it was enacted for, is preventing buyers from writing their own conditions for sale (it is possible – but cumbersome to convince the lawyers, etc., and ask them to modify this or that). In New Zealand, buyer could write any condition in a standard real estate contract and send it to vendor or the agent. Govt is not controlling its getting prewritten by vendor, as there is no stamp duty revenue.

There is a myth created and sustained by media about the rents rising as much as vendors mortgage payments rise because of interest rate rises. The home owners can be compelled by the tightening cycle and can be made to sacrifice in other purchases. But renters and the rental markets have different mechanism and ideas for rent increases in the tightest markets also. Sharing homes, rooms, live in their family homes, etc. In the last decade we have a number of room sharing, house sharing online facilities emerged a lot. Those who lived like that now a days need good feedbacks from others. So a big change in behavioural pattern emerged now. Every roomshare or home share providers as well as renters are very careful about their feedback scores and try to be nice, cordial and very kindly cooperating with each other. This is quite the opposite of real estate rental market, where there is no mechanism to verify the feedback of landlords to know how they treat tenants.

Real estate rules and regulations were skewed to safeguard the landlords more than the renters. In listing rental properties landlords or their agents can seek rent bidding to hike up a property rent to unprecedented levels. It used to be any time landlord can raise the rent. Landlord need not give any reason to give notice to vacate. Landlord need not disclose to the incoming tenant that already the property is listed for sale. If the property is listed for sale, the tenants almost have no option except to agree to buyer inspections as many times requested by the landlord. If the landlord doesn’t repair, the tenant can repair only up to $100, if he intends to claim back. If he doesn’t want to claim back also, he cannot do repair without getting landlord consent. Even hanging a picture on the wall needs to be approved by the landlord. If the rent is missed even briefly, landlord can immediately seek tenant to vacate. If a tenant sings up for 1 or 2 year fixed contract and he wants to vacate for many personal reasons, he can’t move unless he paid rent for the remaining period of rent. In many situations the tenant needs to find a tenant who needs to be approved by landlord, then only he can stop paying rent even though he vacates. What if a person is caught up in a domestic violence situation, can he or she leave the house without being affected by the fixed term contract? No. It is almost slavery created by the system, tenant is almost a slave to the landlord as tenant’s relocation and breaking of contracts were ridiculously costly. Added on to that is the renters register that Governments encouraged and was created to name and shame renters. If the name is in the list, then other landlords will not rent house to them. What about landlord with habit of not repairing anything and letting tenant suffer? There is no feedback system. What about a real estate agent lying about the state of the rental property before signing the contract, is there a mechanism to easily report about his/her behaviour? There is nothing. Is there a mechanism for renters to sue the landlord easily for the health problems created by uninsulated walls, floors, roofs which allows winter cold, or summer heat passes through to tenant – or molds, not tightly closing doors windows causing life threatening ailments? Nothing easily available.

When tide is turning against you, everything goes against you. Now some bad news is there for the homeowners. Rules have changed or changing – it is hell of a change happening that affects them. We discuss about NSW rules change now.

From 17 December 2022, real estate agents in NSW will not be allowed to invite or solicit an offer for rent that is higher than the amount advertised for the property.

Now rules changed so that a tenant can end their fixed-term or periodic tenancy immediately and without penalty if they or their dependent child is in a domestic violence situation.

From 11 December 2020, the regulation clarifies that the landlord is liable for sewerage usage charges, similarly to drainage usage charges which are also payable by the landlord.

From 23-3-2020 for new agreements there is relief for tenants breaking fixed-term agreements of three years or less, when a tenant ends the agreement early. The maximum amount tenant will pay as break fees are set to four weeks rent if less than 25% of the agreement has expired. and it goes down to just one week rent in case of 75% of the agreement has expired.

New standard form of agreement gives option for 5 year rental agreement.

The condition report has been updated including the minimum standards and smoke alarm requirements.

Rent increases for periodic (continuing) agreements will be limited to once every 12 months.

Extended the continuation guarantee (or the so called ‘pay-to-stay’) provisions that apply to tenants in rent arrears to also cover arrears for water usage or utility charges.

So it is getting tougher and tougher for Investors.

What if you want to rent out through room sharing sites like Airbnb so that you can get better rent and more control over the tenants?

We look at that option now, but I tell you that it worked wonderfully well for landlords, in fact I was managing properties of some of my friends – at one time I was managing 20 rooms, although it was tough with international guests, still it was paying for it.

Some phenomena changed the Airbnb renting out rooms plan.

- Covid Restrictions made it impossible for people to move in ,out or stay.

- There were no International and national travelers for the major portion of the last 3 years.

- Students – were not coming from other countries

- State Governments legislated to make it almost impossible to rent shareroom for those who don’t stay in the property. Even for those who stay in the same property it has number of restrictions. Flat owners associations can object to whatever owner wants to do through Airbnb. Ultimately most responsibilities make it worse situation to investors than the normal renting process.

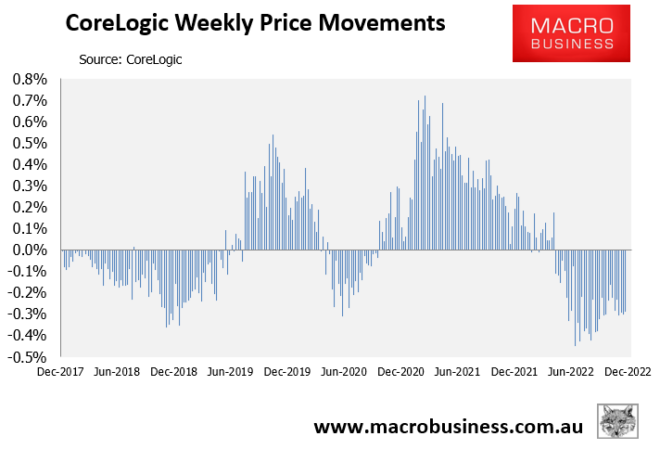

Now when we take a relook at property price declines as shown in above chart mainly brcause of interest rste hikes, we can also see the qualifying amount to income also declined because of interest rate hikes.But that is not small, it is substantial to huge change.

According to Finder, the amount of pre-tax income needed to service a $500,000 mortgage has ballooned from around $121,000 in April 2022 to $181,000 as at December, following the RBA’s 3.0% of interest rate hikes:

Lower borrowing capacity equals lower house prices. And the more the RBA hikes interest rates, the further house prices will fall. The equation is that simple. You have a house whose value is drastically decreasing, still you cant sell as buyers eligibility is also drastically going down; you can t refinance as your eligibility amount as well as your equity will never satisfy refinancier. Debt mortgage finance showed its ugly hidden head built on selfishness and greed of all the players of the market. Now this is market crashing or may be we are finding just evaporation of the real estate as asset class. We would need change it to the Liability side of any Balance Sheet

O.K. enough is enough, if you agree that in the current situation, real estate is a liability then i will continue to write on the ways and methods of how you can come out of of this. You can book for a virtual meeting with me for 10 minutes free of charge .From 11 minutes upwards there are fees. I am not financial advisor nor real estate consultant.. But I am a neutral observer of real estate viewing it from many angles.