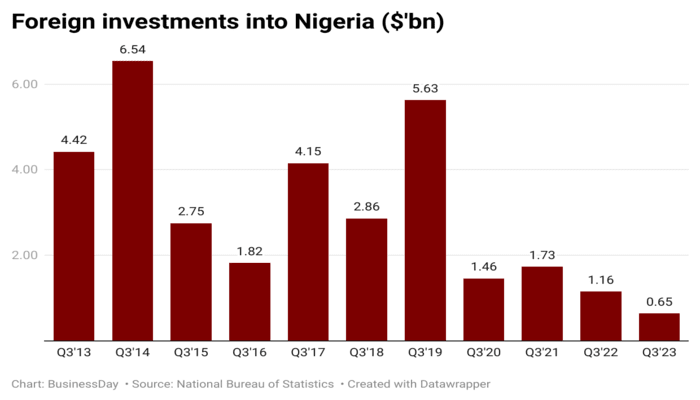

Foreign financial investments into Nigeria plunged to $654.7 million in the 3rd quarter of 2023, the most affordable in a minimum of 11 years, according to the current capital importation report on Friday. The report by the National Bureau of Statistics (NBS), reveals that overall capital importation into Africa’s most significant economy decreased by 36.5 percent to $654.7 million in Q3 from $1.03 billion in the previous quarter. It likewise decreased on a year-on-year basis by 43.6 percent from $1.16 billion in Q3 2022. “Other financial investment ranked leading accounting for 77.6 percent ($507.6 million) of overall capital importation in Q3, followed by Portfolio Investment with 13.3 ($87.1 million) and Foreign Direct Investment (FDI) with 9.13 percent ($59.8 million),” the report stated. It included that production/manufacturing sector taped the greatest inflow with $279.5 million, representing 42.7 percent of overall capital imported in Q3, followed by the funding sector, valued at $127.9 million (19.5 percent), and Shares with $85.5 million (13.1 percent).” “Capital importation throughout the recommendation duration stemmed mainly from the Netherlands with $175.62 million, and taped 26.8 percent share.” According to the analytical firm, this was followed by Singapore with $79.2 million (12.1 percent) and the United States with $67.0 million (10.2 percent). In regards to states, Lagos stayed the leading location in Q3 with $308.8 million, representing 47.2 percent of overall capital importation, followed by Abuja (FCT) with $194.7 million (29.7 percent) and Abia state with $150.1 million (22.9 percent). Stanbic IBTC Bank Plc got the greatest capital importation into Nigeria with $222.8 million (34.0 percent), followed by Citibank Nigeria Limited with $190.0 million (29.0 percent) and Zenith Bank Plc with $83.0 (12.7 percent). Information later on.

- Thu. Jan 29th, 2026