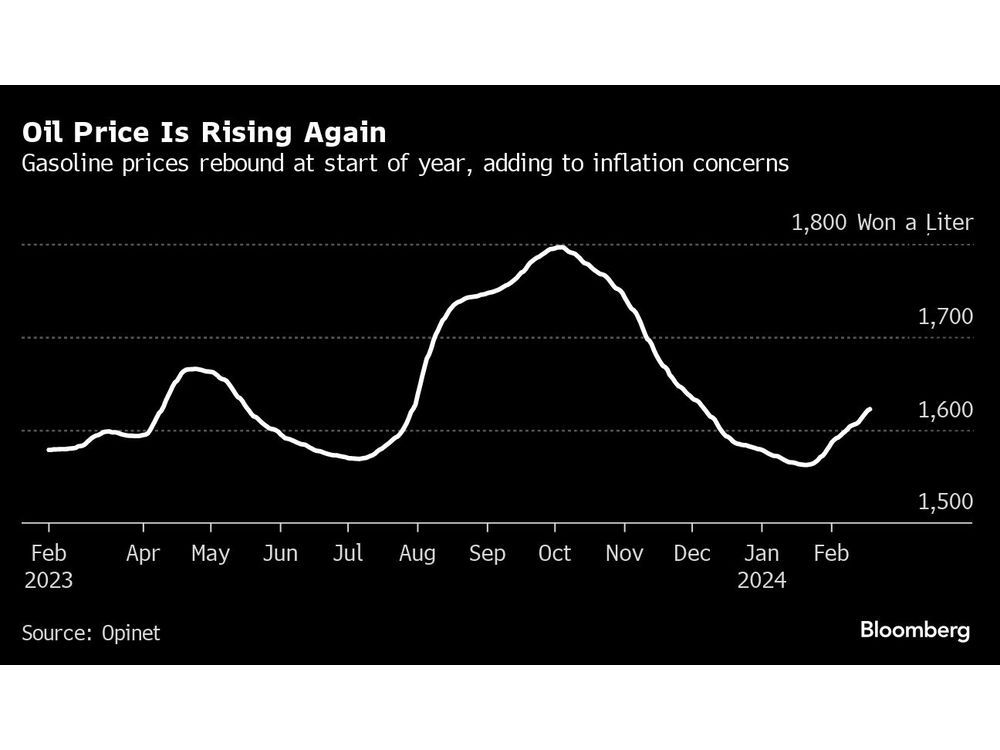

The Bank of Korea cautioned versus overconfidence that inflation is supporting near its target after holding its benchmark rates of interest stable as exports sustain financial activity and energy expenses get due to geopolitical dangers. Author of the post: Published Feb 21, 2024 – 3 minute checked out hijxhaqxuqighe((y7wr7wbh_media_dl_1. png Source: Opinet(Bloomberg)– The Bank of Korea alerted versus overconfidence that inflation is supporting near its target after holding its benchmark rate of interest consistent as exports sustain financial activity and energy expenses get due to geopolitical threats. The reserve bank kept its seven-day repurchase rate at 3.5% Thursday in a choice that matched the expectations of all 19 financial experts surveyed by Bloomberg. The bank last raised the rate in January 2023 and has actually considering that kept it at that level, which it defines as limiting. THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY Subscribe now to check out the most recent news in your city and throughout Canada. Special short articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily material from Financial Times, the world’s leading international service publication.Unlimited online access to check out short articles from Financial Post, National Post and 15 news websites throughout Canada with one account.National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and remark on.Daily puzzles, consisting of the New York Times Crossword.SUBSCRIBE TO UNLOCK MORE ARTICLES Subscribe now to check out the current news in your city and throughout Canada. Special posts from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily material from Financial Times, the world’s leading international service publication.Unlimited online access to check out posts from Financial Post, National Post and 15 news websites throughout Canada with one account.National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and remark on.Daily puzzles, consisting of the New York Times Crossword.REGISTER/ SIGN IN TO UNLOCK MORE ARTICLES Create an account or check in to continue with your reading experience. Gain access to posts from throughout Canada with one account.Share your ideas and sign up with the discussion in the comments.Enjoy extra short articles per month.Get e-mail updates from your preferred authors.Sign In or Create an Accountor Article material Article material The BOK likewise left its heading projections the same, including its view that inflation will balance 2.6% this year, somewhat above the agreement of financial experts, with financial development of 2.1%. It reduced its forecast for core inflation a hair to 2.2%, a sign that the hidden rate pattern is continuing to soften. “While it is anticipated that domestic financial development will continue its enhancing pattern which inflation will preserve its slowing pattern, it is early to be positive that inflation will assemble on the target level,” the BOK stated in a declaration following the choice and the release of its upgraded forecasts. The BOK’s ongoing holding pattern reveals the board stays alert versus a prospective revival in inflation even as consumer-price development has actually slowed to the targeted 2% variety. Continuous disputes in the Middle East and Eastern Europe have actually caused restored strength in worldwide energy costs, keeping South Korean policymakers on their toes as the economy is greatly depending on imported oil and food. “We concur that it is prematurely to state a triumph over inflation,” Jeong Woo Park at Nomura Holdings Inc., stated in a note before the choice. Park stated disinflation will likely end up being more apparent in coming months. By registering you grant get the above newsletter from Postmedia Network Inc. Short article material Article material Continuing development in exports offers the BOK with another factor to avoid reducing its financial settings. The board anticipates external need to assist the trade-reliant economy grow quicker this year compared to in 2015. The yield on the country’s policy-sensitive three-year federal government bond edged down 2 basis points following the lower projection of core inflation. The short-term benchmark yield had actually been as low as 3.15% at the end of December, recommending traders are growing careful of an impending rate cut. The Korean won kept earlier gains stimulated by the dollar’s weak point and enhancements in broad threat cravings. It traded 0.3% greater versus the dollar at around 1,330.60. “The most significant news from the declaration was the cut in the core inflation projection. That’s most likely due to weak domestic usage,” stated Kwon Keejoong, fixed-income expert at IBK Securities Co. Still, with costs still high, the BOK isn’t anticipated to cut a minimum of up until the 2nd half of the year, Kwon included. He anticipates the reserve bank to provide 2 rate cuts then. Speculation over policy rotates this year by the Federal Reserve and European Central Bank has actually assisted generate the expectations that the BOK may do the same, even as unpredictability is plentiful, especially in the United States. Post material What Bloomberg Economics Says … “Growing unpredictability over the course of Federal Reserve policy offers the BOK another factor to keep its policy rate in a limiting zone in the meantime.”– Hyosung Kwon, financial expert To check out the complete report, click on this link “The board is most likely going to work out persistence when it pertains to a rate cut,” stated Moon Junghiu, a financial expert at KB Kookmin Bank. “With inflation inching down towards 2% at the end of this year, arguments for a cut might begin to reinforce, however there’s still anxiousness in minimizing the rate ahead of other reserve banks in the United States and Europe.” Guv Rhee Chang-yong stated last month he does not predict cutting rate of interest in Korea for a minimum of another half year. A freshly included member of the board, Hwang Kunil, appeared to back that view when he revealed issue over higher-than-targeted inflation upon signing up with the board previously this month. Hwang likewise highlighted a series of elements weighing on the South Korean economy, consisting of damaging development capacity. The economy grew at a slower speed in 2015 than in 2022, partially under pressure from international rate of interest raised by reserve banks. Short article material Economists anticipate the seven-person financial policy board to begin lowering the policy rate in the 3rd quarter, a Bloomberg study suggests, and a crucial focus will be how Rhee defines the most likely trajectory of policy when he holds a post-decision rundown soon. Rhee will likewise reveal if there were any dissenters to the most recent choice at an interview beginning quickly after 11 a.m. in Seoul. Markets will have an interest in understanding if any board members mentioned the possible requirement for a quarter-point walking or cut.– With help from Hooyeon Kim. (Adds economic expert remark, market response) Article material

- Fri. Dec 5th, 2025