Shares in Asia edged lower Monday as investors look ahead to US inflation data due Tuesday that is expected to show a further slowing in core prices.

Author of the article:

Bloomberg News

Richard Henderson

Published Mar 10, 2024 • Last updated 8 minutes ago • 4 minute read

pynila14f2hqmdwsw79}eshk_media_dl_1.png CFTC, Bloomberg (Bloomberg) — Shares in Asia edged lower Monday as investors look ahead to US inflation data due Tuesday that is expected to show a further slowing in core prices.

Australian and Japanese shares both fell over 1% while Hong Kong futures inched higher. Contracts for US stocks slipped in Asian trading, extending the downbeat end to the week in the US, where both the S&P 500 and the Nasdaq 100 declined.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others. Daily content from Financial Times, the world’s leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others. Daily content from Financial Times, the world’s leading global business publication. Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account. National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on. Daily puzzles, including the New York Times Crossword. REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account. Share your thoughts and join the conversation in the comments. Enjoy additional articles per month. Get email updates from your favourite authors. Sign In or Create an Account or

Article content

Article content

Support in Hong Kong equity futures follows positive signs for the Chinese economy over the weekend, when authorities reported the first rise in consumer prices since August. The 0.7% increase in February CPI exceeded consensus estimates and is welcome news for investors worried about deflation in the world’s second largest economy.

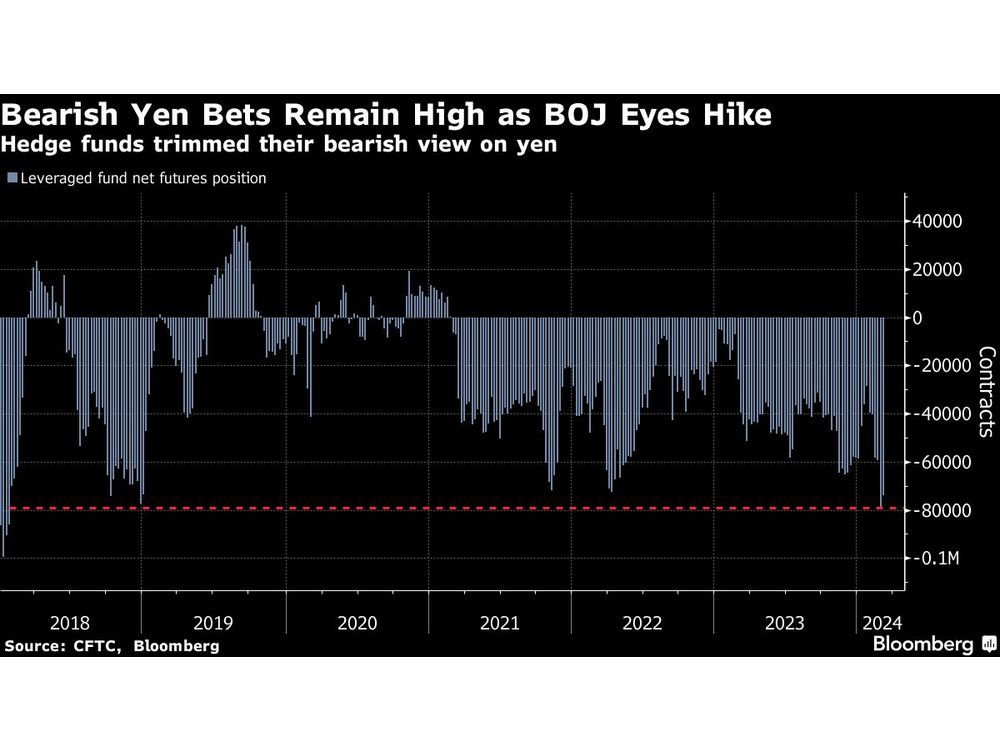

Economic growth in Japan expanded in the fourth-quarter, supporting expectations that the Bank of Japan will raise interest rates for the first time since 2007 as soon as this month. Declines for Japanese shares partly reflected the stronger yen, which typically acts as a headwind for the country’s equities.

The currency was firmer against the greenback in early trading Monday, extending its 2% rally last week against the US currency — its best weekly gain since July. Japanese bond yields gained after a report stating that the BOJ is considering scrapping its yield curve control program.

“Perhaps, Japan is finally coming out of this deflationary vortex and that could have profound implications on Japanese assets,” said Paresh Upadhyaya, director of fixed income and currency strategy at Amundi Asset Management, explaining that this will be supportive for the yen through repatriation flows, mainly going into stocks.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Article content

Tuesday’s US consumer price index figures will dominate the economic data reports this week. The core prices gauge is seen rising 0.3% in February from a month earlier, and 3.7% on a year-over-year basis — which would be the smallest annual rise since April 2021.

Further moderation in US prices would support the disinflation narrative that broadly remains in tact, despite a pullback in the number of Federal Reserve rate cuts expected this year. Swaps pricing shows three cuts are anticipated in 2024, down from six at the start of the year.

Last week’s US jobs data did little to change that outlook. The jobless rate touched a two-year high, even as the number of new jobs added exceeded estimates. The mixed signal points to a slowly cooling labor market that, for now, supports expectations for a soft landing in the US economy.

The jobs report “didn’t necessarily amount to an ‘all-clear’ signal for the Fed, but there also didn’t appear to be anything in it that would derail its plan to cut rates,” said Chris Larkin at E*Trade from Morgan Stanley.

Yields in Australia and New Zealand were largely flat Monday, reflecting the steady trading in Treasuries in early Asian trading. An index of the dollar was slightly weaker after falling 1% last week — the worst weekly showing since December.

Article content

The pullback in US equities on Friday reflected a decline for most of the so-called Magnificent Seven stocks that have powered the US market to fresh highs this year. Nvidia, which has added around $1 trillion to its market value in 2024 alone, fell 5.6%.

In commodities, oil held a loss Monday ahead of reports from OPEC and the IEA this week that may provide clues on the demand outlook. Gold ended Friday almost 1% higher while Bitcoin traded around $69,000, holding its rally over the past few weeks.

Key Events This Week:

CPI reports for Argentina, Brazil, Germany, India, US, Tuesday UK jobless claims, unemployment, Tuesday Japan PPI, Tuesday India industrial production, Tuesday Mexico international reserves, industrial production, Tuesday Philippines trade, Tuesday Turkey industrial production, current account, Tuesday EU finance ministers meet in Brussels, Tuesday ECB Governing Council Member Robert Holzmann speaks, Tuesday Eurozone, UK industrial production, Wednesday India trade, Wednesday South Korea jobless rate, Wednesday ECB Governing Council member Yannis Stournaras speaks, Wednesday Swedish Riksbank First Deputy Governor and Deputy Governor speak, Wednesday Saudi Arabia, Spain CPI, Thursday US PPI, retail sales, initial jobless claims, business inventories, Thursday Australia Treasurer Jim Chalmers delivers pre-budget address, Thursday Canada housing starts, Friday China property prices, Friday France, Italy, Poland CPI, Friday Indonesia trade, Friday Japan tertiary index, Friday New Zealand PMI, Friday Philippines overseas remittances, Friday Sri Lanka GDP US industrial production, University of Michigan consumer sentiment, Empire Manufacturing, Friday Japan’s largest union federation announces results of annual wage negotiations, Friday Article content

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 9 a.m. Tokyo time Hang Seng futures rose 0.2% Japan’s Topix fell 1.1% Australia’s S&P/ASX 200 fell 1.1% Euro Stoxx 50 futures fell 0.3% Currencies

The Bloomberg Dollar Spot Index was little changed The euro was little changed at $1.0942 The Japanese yen rose 0.2% to 146.82 per dollar The offshore yuan was little changed at 7.1993 per dollar The Australian dollar was unchanged at $0.6624 Cryptocurrencies

Bitcoin fell 0.6% to $68,988.85 Ether fell 0.7% to $3,879.4 Bonds

The yield on 10-year Treasuries was little changed at 4.08% Japan’s 10-year yield advanced 2.5 basis points to 0.755% Australia’s 10-year yield was little changed at 3.98% Commodities

West Texas Intermediate crude fell 0.3% to $77.81 a barrel Spot gold rose 0.1% to $2,181.42 an ounce This story was produced with the assistance of Bloomberg Automation.

Article content