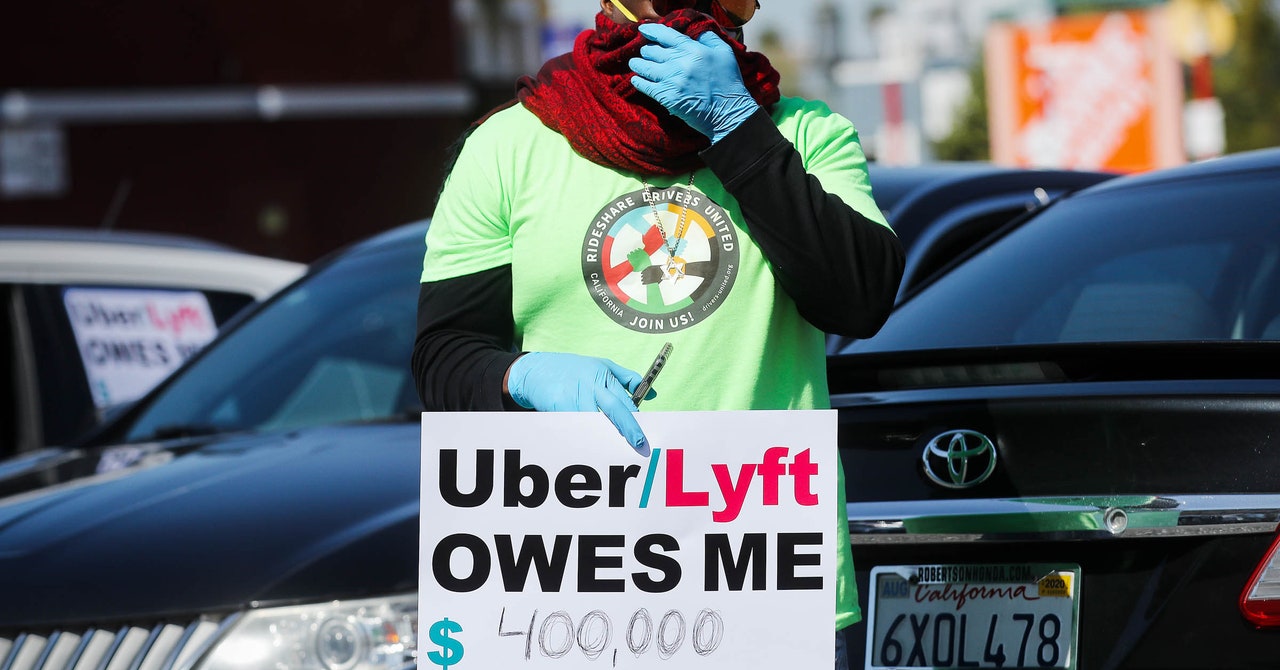

The state of California and three of its biggest cities sued Uber and Lyft Tuesday for misclassifying hundreds of thousands of drivers as independent contractors, in violation of a new state law. The suit argues that drivers are company employees, entitled to minimum and overtime wages, paid sick leave, health benefits, and access to social insurance programs like unemployment.

The suit, under a law known as Assembly Bill 5, threatens to upend the business models of Uber and Lyft, which view themselves as tech-y intermediaries between people who want rides and people willing to drive them. An analysis by Barclays estimates that treating California drivers as employees would cost Uber $506 million and Lyft $290 million annually; neither company is profitable. The state contains two of the companies’ biggest markets, Los Angeles and San Francisco, and both companies’ headquarters.

Want the latest news on ride-hailing in your inbox? Sign up here!

The lawsuit also brings to a head simmering tensions over “gig economy” workers, who have been at the front lines of the coronavirus pandemic. Workers at firms that offer shopping or delivery, such as Instacart and Postmates, have complained that their low wages, determined and managed by platform algorithms, don’t accurately reflect the risks they’re taking to deliver people and goods during a public health crisis.

The new California law kicked in on January 1, but both ride-hail companies—plus other app-based gig companies—have argued that the law unfairly targets their businesses and does not apply to them. AB 5 codifies a 2018 California Supreme Court decision that established a three-part test for businesses employing contractors. According to the test, a worker is only a contractor if they are not under the control or direction of the company while working; if they perform work that is “outside the usual course” of the company’s business; and if they are usually engaged in the same sort of work as they perform for the company. Labor experts (and at least one federal judge) doubt that ride-hail companies can pass that stringent test.

Earlier this year, Ub