2014 and 2021 compared

Natarajan S

BJP or UPA who is better in financial governance

Indian government to borrow a record 16 trillion rupees in fiscal 2023/24 – Reuters poll

BENGALURU (Reuters) – The Indian government will borrow a record 16 trillion rupees ($198 billion) in the fiscal year to March 2024, according to a Reuters poll of economists, who said infrastructure spending and fiscal discipline ought to be its highest budget priorities.

Indian government’s gross indebtedness has more than doubled in the past four years as Prime Minister Narendra Modi’s Government has spent heavily to cushion the economy.

Going back to 8 years, when Modi’s BJP swept to power in 2014, the country’s gross annual borrowing was just 5.92 trillion rupees, now the borrowing of 16 trillion is 270% that of 2014. India’s Per Capita was US$1574 in 2014 and in 2021 it has gone up to US$2277 – 145% that of 2014. GDP in 2014 was US$2039 and in 2021 it was US$3173 155% that of 2014.

Compare that with the previous 8 years before BJP came to power. In 2006 Per Capita was US$807 and it increased to US$1574 in 2014. – 195% that of 2006. GDP in 2006 was US$940 which increased to US$2039 217% of that of 2006. Source: India GDP 1960-2023 | MacroTrends

LET US CONSIDER THE ECONOMIC INDICATORS IN UPA AND BJP REGIMES AT 2014 AND AT 2021 AS PERCENTAGES AND SEE WHO WINS BJP or UPA who is better in financial governance

| In US$ terms | 2006-2014 | 2014-2021 | BJP Govt | UPA govt | Winner |

| GDP increase | 217% | 155% | Minus 62% | 62% | UPA |

| Per Capita increase | 195% | 145% | Minus 50% | 50% | UPA |

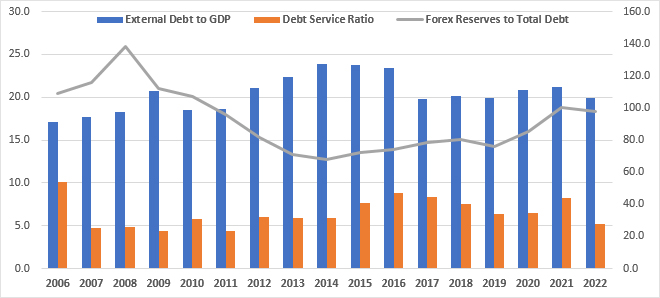

| External Debt as % of GDP | 23.9% of GDP (2014) | 21.2% of GDP (2021) | Less 2.7% | More 2.7% | BJP *but large borrowings expected in 2023-24 |

| Debt Service Ratio Principal +Interest fromexport earnings | 5.9%(2014) | 8.2% 2021 | More2.3% | Less 2.3% | UPA *but changes in 2022 |

| Forex Reserves to Total Debt Ratio | 68.2 %(2014) | 100.6% 2021 | More 32.4% | Less 32.4% | UPA |

The above indicators of 2014 and 2021 are in favour of UPA. But it can change. Debt Service Ratio

Principal +Interest from export earnings changed temporarily in favour of BJP 2022. But year 2023-24 is going to be different.

The Feb. 1 budget will be the last full-fledged one before national elections in 2024 and before elections in several large populous states that will be key tests for the ruling Bharatiya Janata Party (BJP).

But a fall in tax revenue and expected slowing economic growth next fiscal year will limit the Government’s ability to cut borrowing in the near term.

Gross borrowing next fiscal year is expected to hit 16.0 trillion rupees, up from an estimated 14.2 trillion rupees in 2022/23, according to the median forecast of 43 economists.

Predictions were in a narrow range of 14.8 trillion to 17.2 trillion rupees. Even if it is at the lower end of the range, 2023/2024 gross borrowing would easily be the highest on record. When Modi’s BJP swept to power in 2014, the country’s gross annual borrowing was just 5.92 trillion rupees.

“The key reason gross borrowing is going to be still quite high is the repayment burden,” said Dhiraj Nim, economist at ANZ. “The government borrowed a lot in the last few years to have funds for the pandemic, which means the repayment burden will now be quite elevated for several years.”

Nim estimated repayments for 2023/24 at about 4.4 trillion rupees.

While economists in a separate Reuters poll forecast the government would bring the budget deficit down to 6.0% of GDP in 2023/24, it will still be well above the average of 4% to 5% seen since the 1970s and far from the target of reaching 4.5% by 2025/26.

The deficit is more than double what it was before the pandemic. Rising interest rates have increased the burden of repaying the borrowed money.

BJP vs UPA who is better in Financial governance?

DEBT SUSTAINABILITY

The International Monetary Fund said last month India needed a more ambitious plan for fiscal consolidation to ensure debt would be sustainable in the medium term. The government says its current plan is already enough for the task.

The indebtedness of federal and state governments is equal to 83% of annual gross domestic product (GDP), a ratio higher than that of many other emerging economies. The country’s sovereign credit rating is just a notch above junk level.

“With the fiscal deficit and public debt at historical highs, India has to delicately balance fiscal discipline vis-a-vis the need to support growth. The government has to do the heavy lifting on capex,” said Sujit Kumar, economist at Union Bank of India.

Kumar added that infrastructure investment “will be an obvious preference” for spending but an economic slowdown will lower tax collection and that will limit the government’s ability to keep capital expenditure as fast as it has since 2020/21.

The poll also showed the Indian government’s capital expenditure would increase to a record 8.85 trillion rupees, around 2.95% of GDP, in the coming fiscal year.

But growth in such spending would likely slow to barely half the pace of the past three years.

India needs plenty of government funding to overhaul infrastructure to fulfill its ambition of becoming an alternative to China as the world’s factory.

When asked what should be the two most pressing budget priorities, just half of respondents, 18 of 36, said fiscal discipline and infrastructure investment. The other 18 nominated job creation, education, healthcare or rural development.

India’s government will cut food and fertiliser subsidies to 3.7 trillion rupees, more than 25% below the level of around 5 trillion rupees budgeted for 2022/23, the poll found.

($1 = 80.9790 Indian rupees)

BJP vs UPA who is better in Financial governance? From the above indicators you can draw your conclusion.