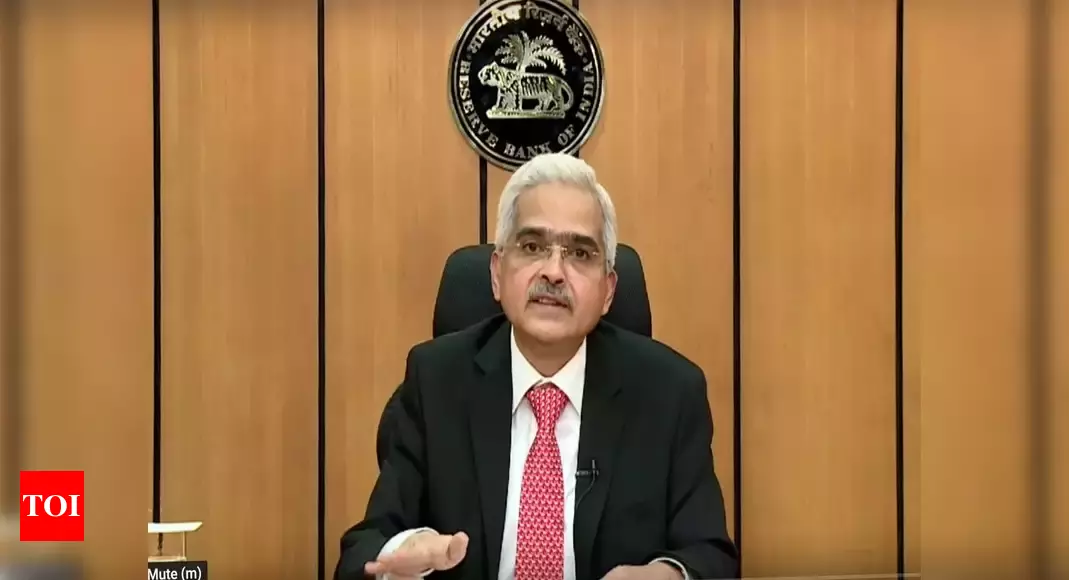

RBI Governor Shaktikanta Das. (PTI)

MUMBAI: The Reserve Bank of India on Friday cut interest rates by 75 basis points (bps)—the sharpest in over a decade. It also made available Rs 3.74 lakh crore of additional liquidity to banks and allowed almost all borrowers to defer loan repayments by three months.

The measures are aimed at buying time for the government to deal with the coronavirus crisis by preventing stressed borrowers from being ejected from the banking system and avoiding bond markets going into a freeze due to the sudden cessation caused by the lockdown.

Advancing the monetary policy committee meeting by a week, RBI governor Shaktikanta Das said, “This decision was warranted by the destructive force of the coronavirus. It is intended to mitigate the negative effects of the virus, revive growth, and above all, preserve financial stability.”

Das said that along with earlier measures, the liquidity made available amounts to 3.2% of the country’s GDP.

The rate cut had its impact with the State Bank of India cutting interest rates on loans by 75 bps. Besides the conventional rate cut, RBI took an unconventional step of making available Rs 1 lakh crore to banks through targete