NEW DELHI: The Reserve Bank of India (RBI) has a number of policy options to draw upon to cushion the economic blow from the coronavirus pandemic.

With a limited fiscal response so far, the RBI has taken the lead in providing virus relief to the economy. It’s cut interest rates by 75 basis points (bps), injected more than $50 billion of liquidity into the financial system, imposed a moratorium on loan repayments and relaxed some regulations on bad loans.

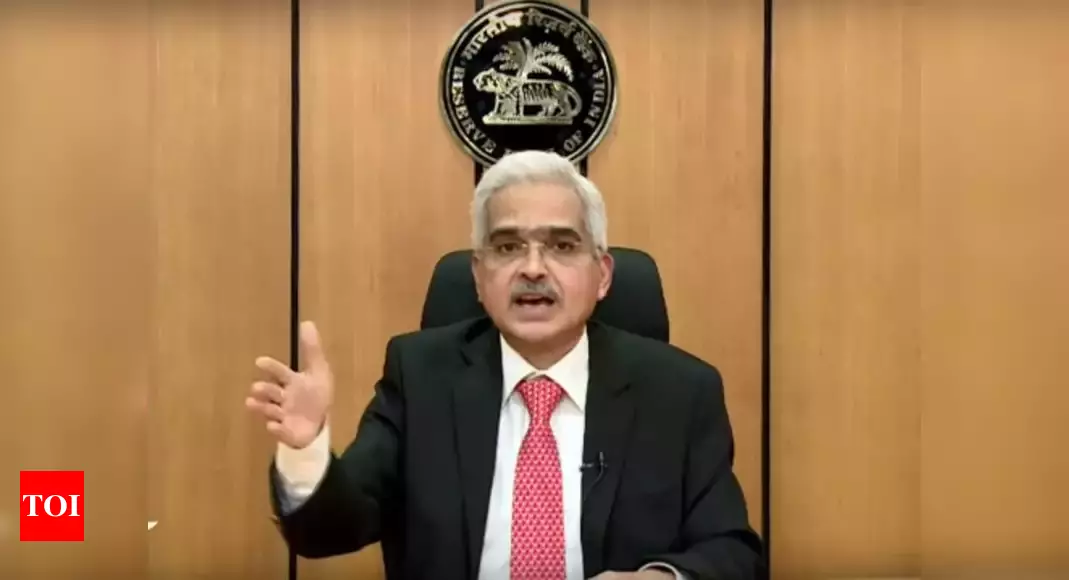

Analysts say governor Shaktikanta Das will need to do a lot more in coming weeks.

Coronavirus outbreak: Live updates

Here’s a look at some of the policy options still available to him:

Rate cuts

Das said last week he expects inflation, which spiked above 7% at the end of last year, to ease below a 4% medium-term target in coming months, giving the RBI room to act. The policy space “needs to be used effectively and in time,” he said, signaling a likely cut in the benchmark interest rate.

“We expect another 75 basis points of cumulative repo rate cuts in 2020 and more unconventional policy measures to follow,” said Sonal Varma, chief economist for India and Asia ex-Japan at Nomura Holdings Inc in Singapore.

Deficit financing

India’s combined budget deficit — which includes the shortfall for the federal government and states — may blow out to above 10% of gross domestic