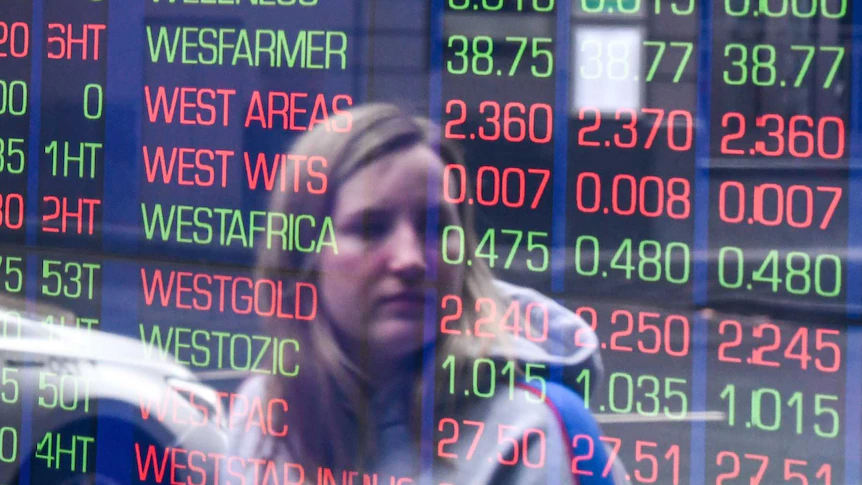

Australian shares absorb started the day decrease, monitoring in a single day losses on Wall Boulevard.

Key aspects:All three Wall Boulevard indexes cease lowerPan-European STOXX 600 index fell 1 per centOil prices toughen as EU leaders to phase out Russian oil

ASX 200 used to be down 41 aspects, or 0.6 per cent, to 7,193 at 10: 07am AEST.

At the identical time, the Australian dollar used to be down, at 71.64 US cents.

Whereas shares of utilities dragged the benchmark down overall at the market’s opening, 10 of the 11 sectors had been procuring and selling increased.

Amongst the worst performers had been Block (-6.7 per cent), Existence360 (-4.1 per cent) and Zip (-3 per cent).

On the flip aspect, Woodside jumped 3.9 per cent, to $31.38, Whitehaven rose 2.3 per cent, to $5.28, and Worley progressed 1.5 per cent, to $14.90.

Wall Boulevard fallGlobal equities fell on Wednesday after stronger-than-expected economic knowledge used to be unable to assuage investor issues of excessive inflation and an impending recession, pushed partly by rising oil prices.

A document by the Institute for Provide Management (ISM) confirmed US manufacturing exercise picked up in Would possibly also merely as build a question to for items remained exact, even with rising prices.

The gape adopted knowledge launched final Friday showing US consumer spending, the last be conscious contributor to American economic output, increased in April, even amid rising issues of a recession.

Market sentiment, alternatively, has remained bearish, as a result of present uncertainty led to by the tempo of the US Federal Reserve’s ardour rate hikes, and the affect of the Russia-Ukraine warfare on food and commodity prices.

“There is a wonderful deal of uncertainty,” acknowledged Michael Ashley Schulman, chief investment officer at Operating Point Capital in Los Angeles.

“If we absorb a recession, it would be contemporary and irregular with nearly chubby employment, companies tranquil hiring and large build a question to for issues.”

The MSCI world fairness index, which tracks shares in 50 worldwide locations, used to be down 0.8 per cent.

Within the period in-between, the pan-European STOXX 600 index fell 1 per cent.

On Wall Boulevard, all three predominant indexes ended decrease, pushed by stocks in the financials, healthcare, abilities and consumer discretionary sectors.

The Dow Jones Industrial Practical fell 0.5 per cent, to 32,813, the S&P 500 lost 0.8 per cent, to 4,101 and the Nasdaq Composite dropped 0.7 per cent, to 11,994.

“Rising ardour charges and inflation are correct compressing valuations,” Mr Schulman added.

“You would possibly maybe well presumably love a company, and it would be accurate and might maybe well proceed to accomplish earnings, but the valuation must tranquil attain down because your tedious ardour rate is rising.”

Oil prices persisted to toughen after the transfer by European Union leaders to steadily phase-out Russian oil, even as China ended its stiff COVID-19 lockdown in Shanghai, which might maybe well bolster build a question to for indecent in an already tight market.

Brent indecent oil used to be up, procuring and selling at $US115.83 a barrel, by 06: 52am AEST.

ABC/Reuters

Posted 4h ago4 hours agoWed 1 Jun 2022 at 9: 33pm, updated 1h ago1 hours agoThu 2 Jun 2022 at 12: 21am