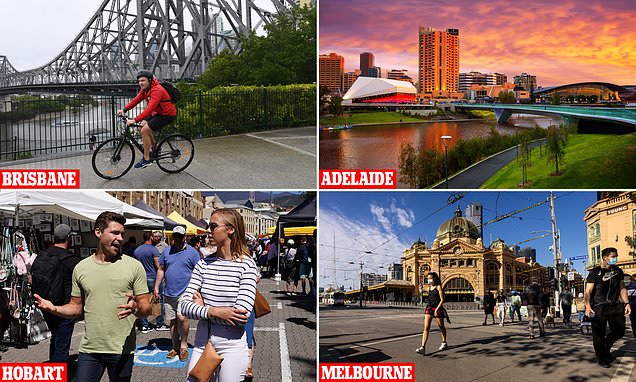

Houses were still economical for typical earners in a few of Australia’s capital cities just 2 years ago – however that has now all altered. An Australian making an average, full-time income in November 2020 might still purchase a median-priced home in Brisbane, Adelaide or Hobart without remaining in home loan tension. Sydney, Melbourne and Canberra were currently unobtainable for a single debtor seeking to purchase by themselves while Perth and Darwin are still possibilities. The Australian Prudential Regulation Authority, the banking regulator, is worried when a customer owes the bank 6 times, or more, of what they make prior to tax. Simply 2 years back, debt-to-income ratios in some of Australia’s significant cities were generally well listed below this limit. Homes were still economical in a few of Australia’s capital cities just 2 years ago however that altered when rates of interest were slashed to a record low. In November 2020, Brisbane’s average home cost was $610,237 and an average, full-time employee making $89,003 with a 20 percent home loan deposit had a debt-to-income ratio of 5.5 (envisioned is a bicyclist in New Farm near the Story Bridge) That altered when Reserve Bank of Australia Governor Philip Lowe and his board slashed the money rate to a record-low of 0.1 percent in November 2020 as Covid lockdowns threatened to rise joblessness. That altered when Reserve Bank of Australia Governor Philip Lowe and his board slashed the money rate to a record-low of 0.1 percent as Covid lockdowns threatened to rise joblessness This saw rates in some cities rise by near to a 3rd in simply a year, with steeper cost boosts in 12 months than the previous years, locking more youthful Australians out of realty. The RBA’s 8 rates of interest increases considering that May, to take on the worst inflation in 32 years, have actually triggered home rates to fall in some cities, however in Brisbane and Adelaide, worths in November 2022 were still greater than a year previously. Joey Moloney, a senior relate to the Grattan Institute believe tank, stated the concern of unaffordable real estate had actually spread out beyond Sydney and Melbourne because the start of the pandemic as more Australians looked for additional home when rates of interest were still low. ‘For a long period of time, the argument about real estate cost, or absence thereof in Australia, was a story focused on to the significant capitals in Melbourne and Sydney,’ he informed Daily Mail Australia. It’s definitely a lot more difficult to purchase a house than it utilized to be. Own a home is progressively out of reach of middle-class Australians.’ ‘But it does look like there’s been a shift in the discussion, where these huge home rates that are far overtaking earnings is not simply a Sydney phenomenon or a Melbourne phenomenon, it’s an all-capital city phenomenon.’ The RBA’s 0.1 percent money rate indicated numerous customers might make the most of ultra-low 2 percent repaired rate home mortgages, causing a rise in home rates. ‘By cutting the money rate to 0.1 percent, which streaming to the rates that banks will charge, that had a significant impact on home costs,’ Mr Moloney stated. When Australia’s capital cities were last economical for average, full-time employee with a 20% home mortgage deposit SYDNEY: 1996 when a home was $255,553 and employees made $35,677 MELBOURNE: 2012 when a home was $530,351 and employees made $72,592 CANBERRA: 2001 when a home was $287,043 and employees made $43,815 BRISBANE: 2020 when a home was $610,237 and employees made $89,003 HOBART: 2020 when a home was $607,020 and employees made $89,003 ADELAIDE: 2021 when a home was $620,610 and employees made $90,917 PERTH: 2022 when a home was $585,989 and employees made $92,030 DARWIN: 2022 when a home was $588,972 and employees made $92,030 Source: CoreLogic average home rate information in November each year minus the 20 percent home mortgage deposit divided by Australian Bureau of Statistic average, weekly regular time profits information Affordability is specified as debtor owing less than 6 times their wage ‘It’s definitely a lot more difficult to purchase a house than it utilized to be. ‘Home ownership is progressively out of reach of middle-class Australians.’ Brisbane In November 2020, Brisbane’s mean home rate was $610,237 and an average, full-time employee making $89,003 a year with a 20 percent home loan deposit of $122,047 had a debt-to-income ratio of 5.5. By November 2021, Brisbane’s middle home rate had actually risen by a tremendous 27.9 percent to $780,684, CoreLogic information revealed. The Queensland capital’s cost development in a year, in dollar terms, had actually exceeded the previous 13 years of worth boosts. Put another method, Brisbane’s average home rate tape-recorded more development from November 2020 to November 2021 than it did from November 2007 to November 2020. An average, full-time employee on $90,917 with a $156,137 home mortgage deposit now had a debt-to-income ratio of 6.9 – well into home mortgage tension area. Rate increases this year have actually seen Brisbane worths reverse in current months however the average home rate of $798,552 is still 2.3 percent much better than a year earlier. An average, full-time employee on $92,030 with a one-fifth home mortgage deposit of $159,710 would still have a debt-to-income ratio of 6.9. Adelaide In November 2020, Adelaide’s mid-point home cost was $500,934 and an average-income employee on $89,003 with a 20 percent home mortgage deposit of $100,187 had a workable debt-to-income ratio of 4.5. A year later on, the city’s mean home cost rose 24 percent to $620,610. A typical employee on $90,917 with a home mortgage deposit of $124,122 had a debt-to-income ratio of 5.5 – still listed below the home mortgage tension limit. In November 2021, Adelaide’s typical home rate had more than the year rose 24 percent to $620,610. A typical employee on $90,917 with a home mortgage deposit of $124,122 had a debt-to-income ratio of 5.5 – still listed below the home loan tension limit (imagined is the River Torrens) But Adelaide home rates continued to skyrocket, increasing by another 13.2 percent throughout the previous year to $702,392. A full-time employee on $92,030 with a home loan deposit of $140,478 would have a debt-to-income ratio of 6.1 – now in home loan tension area. Throughout the previous 2 years, Adelaide home costs have actually skyrocketed by 40.2 percent. In dollar terms, the South Australian capital had more development in 2 years than the previous 17 years. Hobart In November 2020, Hobart’s average home cost was $607,020, which suggested an average-income employee on $89,003 with a 20 percent home loan deposit of $121,404 had a workable debt-to-income ratio of 5.5. Within a year, the Tasmanian capital’s had actually risen by 26.5 percent to $768,288. An average-income employee on $90,917 with a one-fifth home mortgage deposit of $153,658 had a debt-to-income ratio of 6.8 – in home mortgage tension area. Rates have considering that decrease partially to $740,100 however a typical full-time employee on $92,030 with a home mortgage deposit of $148,020 would still remain in the home loan tension zone with a debt-to-income ratio of 6.4. In November 2020, Hobart’s average home cost was $607,020, which indicated an average-income employee on $89,003 with a 20 percent home loan deposit of $121,404 had a workable debt-to-income ratio of 5.5 (visualized are the Salamanca Markets) The rest Perth’s mean home rate of $585,989 is still budget-friendly. A full-time employee on $92,030 with a home mortgage deposit of $117,198 would have a workable debt-to-income ratio of 5.1. The story is comparable in Darwin where the average home rate of $588,972 would likewise produce a debt-to-income ratio of 5.1. Sydney’s typical home cost of $1,243,126 implies that even with a tremendous 20 percent home mortgage deposit of $248,625, somebody owing near $1million would have a debt-to-income ratio of 10.8. Australia’s most pricey city hasn’t been cost effective for an average-income earner given that November 1996, passing historical CoreLogic information. At that time, Sydney’s typical home rate was $255,553 and an average, full-time employee on $35,677 with a 20 percent deposit of $51,111 had a debt-to-income ratio of 5.7. A years earlier, in November 2012, Melbourne (Flinders Street Station envisioned in 2015) had an average home rate of $530,351. An average, full-time employee making $72,592 with a 20 percent home loan deposit of $106,070 had a debt-to-income ratio of 5.8 Big cities unaffordable regardless of current cost falls SYDNEY: Down 1.5 percent in December and down 13.2 percent in 2022 to $1,221,367 MELBOURNE: Down 1.4 percent in December and down 9.4 percent in 2022 to $905,894 BRISBANE: Down 1.7 percent in December and down 2.5 percent in 2022 to $786,198 ADELAIDE: Down 0.5 percent in December however up 9.6 percent in 2022 to $701,493 PERTH: Up 0.2 percent in December and up 3.9 percent in 2022 to $586,721 HOBART: Down 2.1 percent in December and down 6.6 percent in 2022 to $725,736 DARWIN: Down 0.7 percent in December however up 4.5 percent in 2022 to $588,503 CANBERRA: Down 1.4 percent in December and down 4.9 percent in 2022 to $961,636 Source: CoreLogic average home rate information for December 2022 CoreLogic’s historical home rate information has greater figures than a 2004 research study by previous Macquarie University academics Peter Abelson and Demi Chung. Melbourne’s mean home rate of $915,005 in November 2022 indicated somebody making $92,030, with a 20 percent home mortgage deposit of $183,000, would have a debt-to-income ratio of 8. A years earlier, in November 2012, the Victorian capital had a typical home rate of $530,351. An average, full-time employee making $72,592 with a 20 percent home loan deposit of $106,070 had a debt-to-income ratio of 5.8. Canberra’s typical home cost of $987,450 is unaffordable for an average, full-time employee on $92,030. This customer, with a 20 percent deposit of $197,490 would have a debt-to-income ratio of 8.6, although Canberra public servants generally make greater wages, making them much less most likely to be in home loan tension. The mid-priced Canberra home hasn’t been inexpensive considering that November 2001, when houses with a yard generally cost $287,043, after a number of flat years following the Howard federal government’s downsizing of the general public service. An average, full-time employee on $43,815 with a 20 percent home loan deposit of $57,409 had a debt-to-income ratio of 5.2. In 2022, none of Australia’s capital city markets are budget-friendly for a typical income employee on $65,000 wanting to purchase a median-priced home. Perth and Darwin are still available for an average, full-time employee on $92,030 looking for the mid-priced home, a scenario that was possible in Adelaide up until 2021 and Brisbane and Hobart up until 2020. Coastal local locations in NSW, southern Queensland and Victoria have actually ended up being a lot less economical as more individuals who might work from house picked to live near the beach. Mr Moloney stated debtors who owed more than 6 times what they made were at specific threat of not having the ability to service the month-to-month home loan payments, with more rate of interest increases anticipated. ‘The more financial obligation you have, relative to the earnings can be found in to service that financial obligation, the less space you need to move if the expense of maintenance that financial obligation, which is to state rates of interest, increase,’ he stated.

- Tue. Mar 10th, 2026