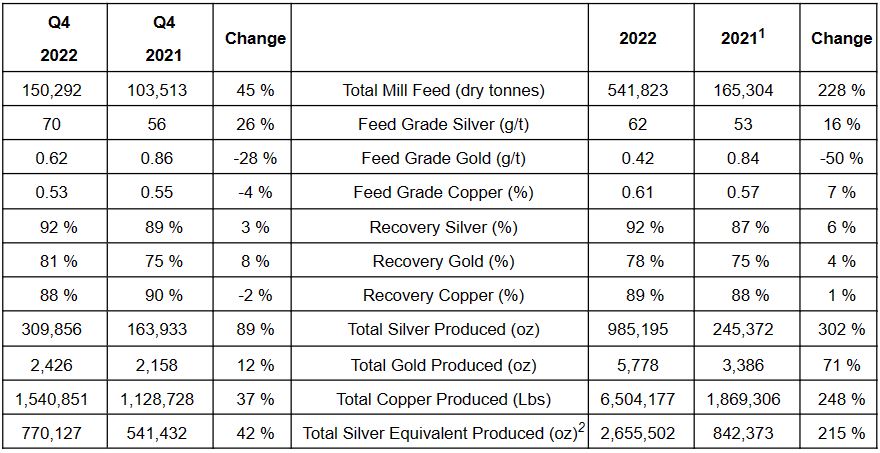

Avino Silver & Gold Mines Ltd. (TSX: ASM) (NYSE: ASM) (FSE: GV6) (“Avino” or “the Company”) is happy to report complete year 2022 production outcomes of 2,655,502 silver comparable ounces. 4th quarter production amounted to 770,127 silver comparable ounces which surpassed expectations. Production Highlights– Q4 2022 (Compared to Q4 2021) Silver comparable production increased 42% to 770,127 oz2 Silver production increased by 89% to 309,856 oz Copper production increased by 37% to 1.5 million pounds Gold production increased by 12% to 2,426 oz Mill throughput increased by 45% to 150,292 tonnes Avino Mine Production– Three Months and Full Year Ended December 31, 2022 compared to Q4 2021 & 2021 “The Avino Mine continued to outshine in the last quarter of 2022, constructing on our record 3rd quarter production outcomes,” stated David Wolfin, President and CEO of Avino. “We had an internal production quote in between 2.2 and 2.4 million silver comparable ounces, and we beat the luxury of that by over 250,000 silver comparable ounces. This stable production shows the quality of the Avino Mine possession along with the mine website group’s capability to continuously enhance operations. We continue enhancing underground mining procedures, growing and training a regional labor force, and practicing sound monetary duty at the mine website and at the business level. The dry-stack tailings center has actually been finished together with the start-up screening and we are delighted to report that it is now totally functional. We have a 5-year objective to accomplish intermediate manufacturer status and the method in location to achieve strong production development over the next 5 years. We eagerly anticipate continuing enhancement on our functional successes in 2023.” 2022 Fourth Quarter Highlights Production at Avino Continues to Deliver: Silver comparable production of 770,127 ounces represents Avino’s 2nd greatest production quarter in current times, constructing on our record setting 3rd quarter outcomes. Dry-Stack Tailings Facility Commissioned: The setup and commissioning of the dry-stack tailings task has actually been finished along with the start-up screening, and the center is now totally functional. Avino selected dry-stack tailings for its ecological, security and financial benefits. Dry-stack tailings enhance the total tailings center security and stability and minimizes the requirement to extract water from regional sources by recycling the water gotten rid of from tailings. In addition, dry-stack tailings need less storage location which leads to a smaller sized ecological footprint. Declared ET Area Drilling Results: On October 11, 2022, Avino revealed more drill arises from the most current 6 holes at the Avino Elena Tolosa (“ET”) location listed below our inmost Level 17 mining location. These drill outcomes verified the downdip connection of widths and grades of the Avino vein extending substantial capacity to a depth of a minimum of 290 metres down dip listed below the existing inmost advancement. Avino is advancing geological modelling to figure out the prospective geometry and controls of the mineralization. All 3 of Avino’s drills are presently working targeted at determining the level of the mineralization listed below the existing production operations. At the end of Q4 2022, an overall of 3,430 metres had actually been drilled bringing the overall for the year to 15,582. More drilling near completion of Q4 2022 led to assays gotten and reported on January 5, 2023 revealing the Avino Vein now extending 315 metres listed below the inmost Level 17 mining location, along with showing the Avino vein is getting richer in copper at depth with a grade of 1.63% copper over 16.66 metres in Hole #ET 22-12. La Preciosa Update The Company is performing neighborhood engagement in the close-by towns nearby to the home and will supply more updates as strategies establish. Avino is totally dedicated to moving this job forward as it elements plainly in the Company’s 5-year development method. Non-Core Asset Update During the 4th quarter, Avino settled the choice arrangement with Endurance Gold (“Endurance”) on the Olympic Claims situated in the Bridge River Valley in British Columbia, Canada (see press release here). Even more, Avino has actually gotten the 2nd turning point payment in money and shares that was due on or prior to on December 31, 2022, verifying that the alternative contract stays in result. 2023 Outlook & 2022 Year in Review The Company will launch its prepare for 2023 and an evaluation of achievements and turning points attained in 2022 in the coming weeks. Quality Assurance/Quality Control Mill assays are carried out at the Avino residential or commercial property’s on-site laboratory. Examine samples were sent to SGS Labs in Durango, Mexico for confirmation. Gold and silver assays are carried out by the fire assay approach with a gravimetric surface for focuses and AAS (Atomic Absorption Spectrometry) approaches for copper, lead, zinc and silver for feed and tail grade samples. All concentrate deliveries are assayed by among the following independent third-party laboratories: Inspectorate in the UK, and LSI in the Netherlands and AHK. Certified Person(s) Peter Latta, P. Eng, MBA, Avino’s VP Technical Services, is a certified individual within the context of National Instrument 43-101 who has actually examined and authorized the technical information in this press release. About Avino is a silver manufacturer from its completely owned Avino Mine near Durango, Mexico. The Company’s silver, gold and copper production stays unhedged. The Company’s objective and method is to develop investor worth through its concentrate on lucrative natural development at the historical Avino Property and the tactical acquisition of the La Preciosa home. Avino presently manages mineral resources, based on NI 43-101, that amount to 290 million silver comparable ounces, within our district scaled land plan. We are dedicated to handling all organization activities in a safe, ecologically accountable, and affordable way, while adding to the wellness of the neighborhoods in which we run. We motivate you to get in touch with us on Twitter at @Avino_ASM and on LinkedIn at Avino Silver & Gold Mines. To see the Avino Mine VRIFY trip, please click here. ON BEHALF OF THE BOARD “David Wolfin” David Wolfin President & Chief Executive Officer This press release includes “positive info” and “positive declarations” (together, the “forward looking declarations”) within the significance of suitable securities laws and the United States Private Securities Litigation Reform Act of 1995, consisting of the changed mineral resource quote for the Company’s Avino Property situated near Durango in west-central Mexico (the “Avino Property”) with a reliable date of January 13, 2021, and as changed on December 21, 2021, and the Company’s upgraded mineral resource quote for La Preciosa with an efficient date of October 27, 2021, gotten ready for the Company, and referrals to Measured, Indicated, Inferred Resources described in this news release. These positive declarations are made since the date of this press release and the dates of technical reports, as suitable. Readers are warned not to put unnecessary dependence on positive declarations, as there can be no guarantee that the future situations, results or outcomes prepared for in or suggested by such positive declarations will take place or that strategies, intents or expectations upon which the positive declarations are based will happen. While we have actually based these positive declarations on our expectations about future occasions as at the date that such declarations were prepared, the declarations are not a warranty that such future occasions will take place and undergo threats, unpredictabilities, presumptions and other elements which might trigger occasions or results to vary materially from those revealed or suggested by such positive declarations. No guarantee can be considered that the Company’s Avino Property nor the La Preciosa Property have the quantity of the mineral resources suggested in their reports or that such mineral resources might be financially drawn out. Such elements and presumptions consist of, to name a few, the results of basic financial conditions, the cost of gold, silver and copper, altering foreign exchange rates and actions by federal government authorities, unpredictabilities connected with legal procedures and settlements and mistakes in the course of preparing positive details. In addition, there are recognized and unidentified danger aspects which might trigger our real outcomes, efficiency or accomplishments to vary materially from any future outcomes, efficiency or accomplishments revealed or indicated by the positive declarations. Understood danger aspects consist of dangers related to job advancement; the requirement for extra funding; functional threats related to mining and mineral processing; the COVID-19 pandemic; volatility in the international monetary markets; changes in metal costs; title matters; unpredictabilities and threats connected to continuing organization in foreign nations; ecological liability claims and insurance coverage; dependence on essential workers; the capacity for disputes of interest amongst specific of our officers, directors or promoters with specific other jobs; the lack of dividends; currency changes; competitors; dilution; the volatility of the our typical share cost and volume; tax repercussions to U.S. financiers; and other dangers and unpredictabilities. We have actually tried to determine crucial aspects that might trigger real actions, occasions or results to vary materially from those explained in positive declarations, there might be other aspects that trigger actions, occasions or results not to be as prepared for, approximated or planned. There can be no guarantee that positive declarations will show to be precise, as real outcomes and future occasions might vary materially from those expected in such declarations. Appropriately, readers ought to not put unnecessary dependence on positive declarations. We are under no responsibility to upgrade or change any positive declarations other than as needed under appropriate securities laws. For more in-depth details relating to the Company including its threat elements, financiers are directed to the Company’s Annual Report on Form 20-F and other regular reports that it submits with the U.S. Securities and Exchange Commission. Referrals to Measured & Indicated Mineral Resources and Inferred Mineral Resources in this news release are terms that are specified under Canadian guidelines by National Instrument 43-101 (“NI 43-101”). On October 31, 2018, the United States Securities and Exchange Commission embraced Item 1300 of Regulation S-K (“Regulation SK-1300”) to update the home disclosure requirements for mining registrants, and associated assistance, under the Securities Act of 1933 and the Securities Exchange Act of 1934. All registrants are needed to adhere to Regulation SK-1300 for ending after January 1, 2021. Guideline SK-1300 utilizes the Committee for Mineral Reserves International Reporting Standards (“CRIRSCO”) based category plan for mineral resources and mineral reserves, that consists of meanings for presumed, suggested, and determined mineral resources. U.S. Investors are warned not to presume that any part of the mineral resources in these classifications will ever be transformed into possible or tested mineral reserves within the significance of Regulation S-K 1300. Footnotes: 1After a duration of functional closure, the Avino Mine rebooted production throughout Q3 2021. 2In Q4 2022, AgEq was computed utilizing metal rates of $21.18 per oz Ag, $1,729 per oz Au and $3.63 per pound Cu. In Q4 2021, AgEq was determined utilizing metal rates of $23.32 per oz Ag, $1,783 per oz Au and $4.39 per pound Cu. In 2022, AgEq was computed utilizing metal costs of $21.75 per oz Ag, $1,801 per oz Au and $4.00 per pound Cu. In 2021, AgEq was determined utilizing metal costs of $23.84 per oz Ag, $1,786 per oz Au and $4.32 per pound Cu. Continue Reading

- Sat. Mar 7th, 2026