There was Trump. Enough stated.

In Australia, the Labor Party eliminated its excellent generational skill in Kevin Rudd– seemingly since he was a requiring employer– and misused much of the rest of its time in federal government with the Rudd-Gillard wars. The Abbott federal government left to a stunning start with its unusual 2014 budget plan and never ever recuperated. The Liberal Party’s intramural bickering in between Malcolm Turnbull and Tony Abbott damaged their premierships. There was Scott Morrison. Enough stated.

The overarching lesson of the 2010s is that there’s no alternative to great federal governments that make huge reforms.

Considering that about 2010, main banks have– typically reluctantly– attempted to utilize financial policy as a replacement for what political leaders weren’t doing. And, unsurprisingly, it didn’t work especially well. Monetary policy has a beneficial function to play in raveling organization cycles and thawing monetary markets in distress, however it is a poor replacement for federal government policies that can make the economy more vibrant and versatile.

The most significant example, naturally, was extending quantitative easing (QE) to settings where monetary markets were in fact working rather well. There is little proof that the Fed’s so-called QE2 and QE3 bundles, in late 2010 and 2012, respectively, assisted the genuine economy, however there’s lots of proof that they pumped up property rates and urged financiers to take higher threats.

In Australia, QE started in 2020 as part of the reaction to the coronavirus pandemic. In some methods, the RBA didn’t devote rather the very same sins as the Fed, or a minimum of not as early. It did, nevertheless, choose to set a target rate of 0.10 percent for three-year federal government bonds (the so-called “yield-curve control”), which did all the bad things that QE2 and QE3 carried out in the United States, plus set a sort of target for monetary markets to attack. The marketplaces did this effectively, making the RBA look silly.

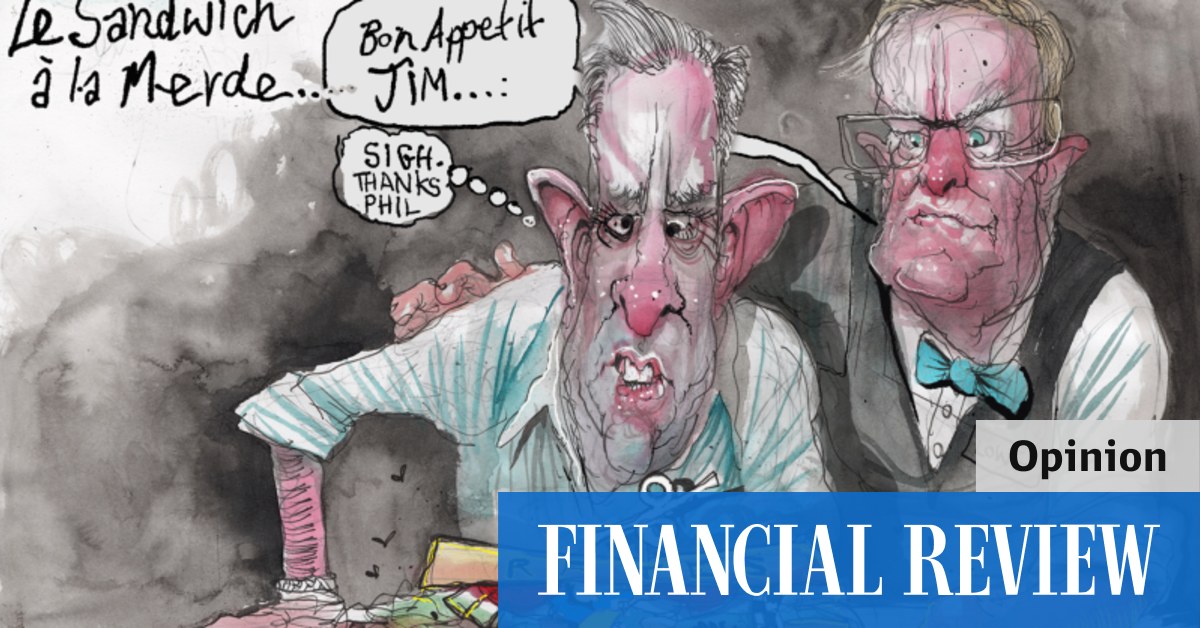

And who can forget Philip Lowe’s forward assistance about short-term rate of interest remaining at 0.10 percent till a minimum of 2024. Taken together, these oversights have actually done severe damage to the RBA’s credibility and reliability.

That stated, decreasing short-term rates of interest, which the Fed– and RBA to a lower degree)– did, assisted their economies adjust to the brand-new regular of excessive conserving chasing too couple of large-dollar financial investment chances. This is what previous treasury secretary Larry Summers (re)-created as “nonreligious stagnancy”, and it’s still a function of sophisticated economies.

The overarching lesson of the 2010s is that there’s no replacement for excellent federal governments that make huge, essential financial reforms. Australia under Hawke-Keating, the United States under Clinton, and the UK under Blair made significant and crucial financial reforms. And all 3 nations have actually had near to absolutely nothing like it because.

We have actually seen the repercussions of this policy vacuum in stagnant genuine salaries, lower financial development, and pre-pandemic joblessness levels that were far too expensive. And we’ve seen what occurs when well-meaning main lenders attempt to fill that space. It results in a boost in possession costs (property, stocks and more) that clearly favours those who own properties and puts our intergenerational social agreement under pressure. And it results in extreme risk-taking in monetary markets that, paradoxically, makes it less most likely that the reserve banks will minimize their liquidity infusions.

To paraphrase famous bond trader Mohamed El-Erian, nations such as Australia, the United States and the UK required an individual fitness instructor in the 2010s. We required a federal government to press us to do the often agonizing effort that results in long-lasting health and durability. In the lack of that, we got a medical professional recommending great deals of medication that didn’t change the effort, however did result in great deals of unsightly negative effects. We required a Keating, and we got “pill-popper MD”.

The Albanese federal government appears to have little interest in basic, productivity-enhancing reforms to the tax or education systems, or to the labour market. And if Treasurer Jim Chalmers will not be our individual fitness instructor, then we can anticipate Lowe’s follower to keep recommending medication.