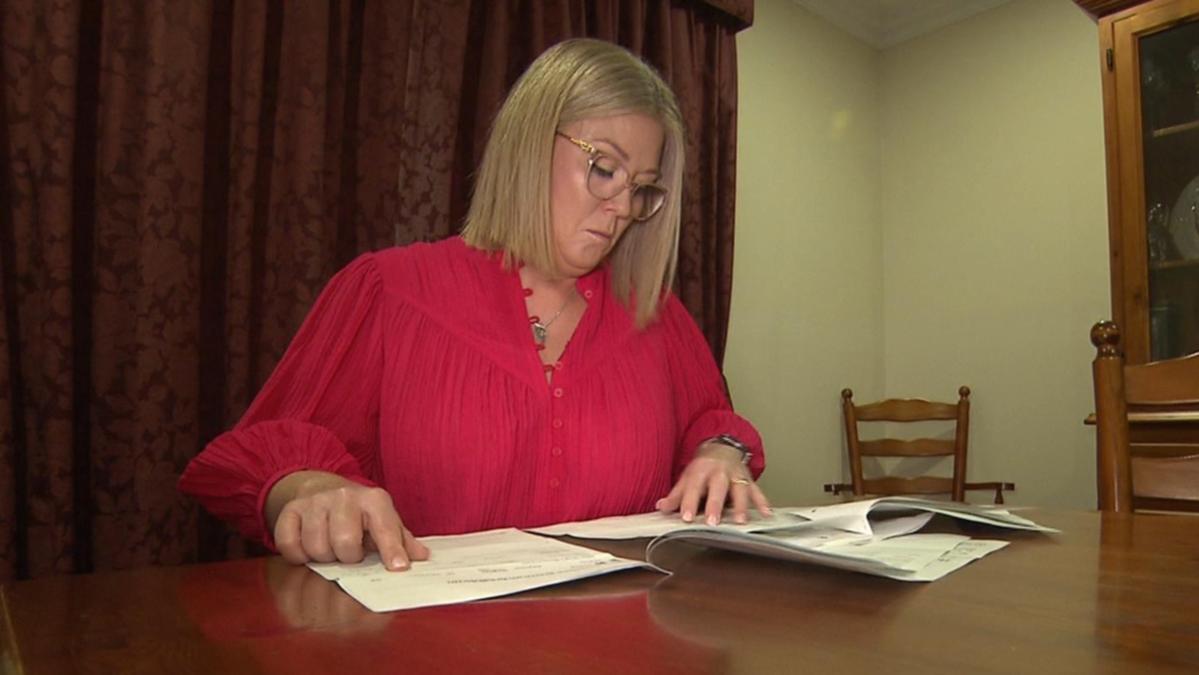

The expense of basic insurance coverage for family possessions such as home and automobiles will continue to increase, providing homes no relief after comparable boosts in 2015, a professional has actually cautioned. KPMG insurance coverage partner Scott Guse stated he prepared for premium rates throughout basic insurance coverage individual lines would increase by about 10 percent in 2023, after 3 years of successive boosts. ENJOY VIDEO ABOVE: property owners having a hard time to pay expense of insurance coverage Watch the most recent news and stream free of charge on 7plus >> “On average we most likely saw rate boosts in the worlds of 10 percent in 2022 and I would not be shocked to see comparable boosts in 2023,” he stated. Premiums of individual lines of basic insurance coverage have actually increased as the COVID-19 pandemic ended, and peaked in 2015 as life went back to regular and Guse stated individuals’s “danger profiles” altered. He stated the boosts were likewise the outcome of extreme weather condition, inflation, and the expense of re-insurance– insurance coverage for insurance providers– likewise increasing. “Insurance business are great at danger ranking residential or commercial properties for the prospective claims that might develop,” he stated. “Where a home is more impacted by a prospective claim, their premiums will go greater than 10 percent, where they’re less impacted, they’ll increase by less than 10 percent.” Debra Woodards stated she would not take flood insurance coverage for her residential or commercial property this year since the premium was too pricey. Credit: 7NEWSBlanchetown homeowner Debra Woodards remains in precisely that position. Her residential or commercial property in South Australia’s Riverland has actually been immersed under floodwaters considering that completion of in 2015, when the River Murray experienced high circulations. Prior to Christmas 2022 the yearly cost of her house and contents insurance coverage, that included flood cover, increased from $1800 to nearly $43,500. “I simply didn’t understand what to do. Didn’t understand if we were going to have the ability to make a claim,” Woodards stated. “(It’s) entirely unaffordable, that’s an individual’s wage.” The floods are the worst natural catastrophe in South Australia’s current history, with countless residential or commercial properties swamped, requiring lots of locals to leave their towns. Woodards stated she was provided her insurance coverage costs prior to Christmas, with a due date of January 2023. Credit: 7NEWSWoodards stated she and other Blanchetown households could not pay for to cover their homes for future flood catastrophes. “The typical individual’s not going to have the ability to manage them … We’re simply going to take the gamble and not have the ability to manage flood insurance coverage, so we will not do it.” Australia’s monetary services regulator APRA stated in its quarterly basic insurance coverage efficiency report for September 2022, the market had actually gotten $43.3 billion in net made premiums, a boost of 10.3 percent over the very same duration in 2021. “Premium boosts were more popular in the homeowners, domestic motor, fire and commercial unique dangers, expert indemnity and reinsurance classes of service,” the report mentioned. Homeowners along the River Murray in South Australia were struck with insurance coverage boosts since of floods. Credit: 7NEWSGuse stated federal governments might assist moderate the expense of insurance coverage by enhancing the readiness of towns and neighborhoods versus disastrous weather condition occasions. “The most significant thing that’s driving the expense up in house insurance coverage is an absence of strength in the building regulations and carries out,” he stated. “You see cyclones harm houses that must have been developed to specific requirements. “There’s been a variety of research studies that have actually revealed if you invest $10 million in durability you can really get fivefold back in regards to insurance coverage cost savings.” Service insurance coverage to moderateMeanwhile, for business sector, the expense of premiums is anticipated to moderate in 2023, other than for home insurance coverage. John Donnelly from worldwide industrial insurance coverage broker, Marsh, stated the peak of costs for business insurance coverage was 2020, and information programs costs were typically not looking like they ‘d increase even more. The brokerage reported business home insurance coverage saw a 4 percent boost in the September to December quarter along with the quarter prior to that. Causality insurance coverage, that included public liability insurance coverage, likewise saw a 10 percent boost in the last 2 quarters of 2022, while monetary and expert lines saw no boost at all. The expense of business home insurance coverage, such as individual house and contents insurance coverage, would likely increase in 2023. Credit: Elias/Getty Images/iStockphotoDonnelly stated while cyber insurance coverage had actually increased 28 percent at the end of 2022, it would likewise start to moderate. Like house and contents insurance coverage, business residential or commercial property premiums were not likely to get less expensive, he stated. “Cyber insurance coverage is increasing, however not increasing near the level it remained in 2022 … when we were seeing triple digital boosts,” Donnelly stated. “The home they’re (services) are guaranteeing is increasing in regards to worth. The expense to change a structure more in 2023 than in 2020 since of inflation.” Bindi’s psychological battles as she makes destructive statement. Bindi’s psychological battles as she makes disastrous statement.

Find out more

If you were struck with insurance coverage premium cost walkings in 2015, prepare yourself for more problem as cost-of-living bites