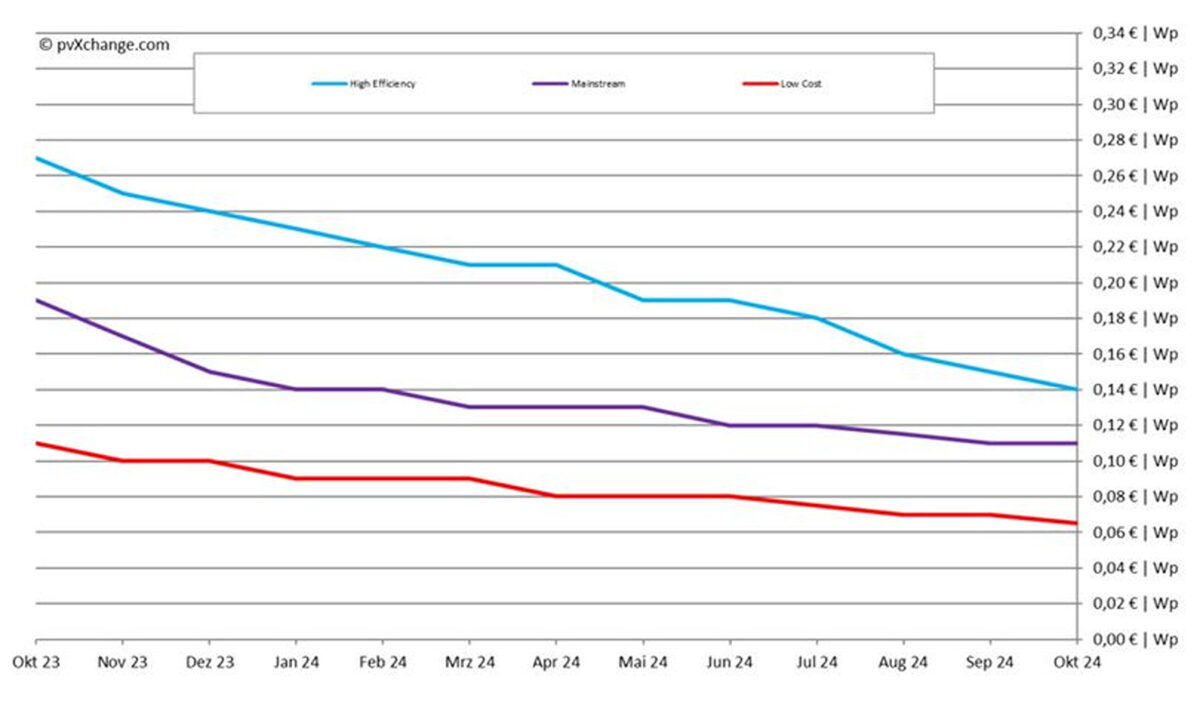

Martin Schachinger, the creator of pvXchange.com, reports that tunnel oxide passivated contact (TOPCon) solar module rates in Germany have actually fallen by approximately EUR0.010 ($0.0109)/ W this month. Need stays particularly weak in the property sector, while complicated permission procedures are likewise challenging the industrial and commercial (C&I) and ground-mounted sections. October 21, 2024 MARTIN SCHACHINGER, PVXCHANGE.com From pv publication Germany The PV market in Germany is having a hard time, with business insolvencies accumulating, showing a pattern seen throughout all sectors. According to Deutsche Wirtschaftsnachrichten, the variety of insolvencies in the 3rd quarter of 2024 reached a high not seen considering that 2010, primarily due to self-inflicted issues and continuous cost decreases. This month, the rate decreases generally impacted TOPCon modules in the greater efficiency classes, which fell by approximately EUR0.010/ W, while rates for other module classes stayed mainly the same. Numerous providers are still under pressure, decreasing the value of even popular brand names simply to enhance sales. The previous 6 to 9 months reveal this technique isn’t always working. Regardless of lower costs for elements and turnkey systems, need and sales figures have not seen a matching boost. There is still strong hesitation to purchase, especially in the domestic sector, due to unpredictability about long-lasting financial conditions and private earnings. The expense of living continues to increase, in spite of weaker inflation, along with increasing permission times from administrations and authorities. Current rates of interest cuts have actually stopped working to enhance the financial investment environment. New setups throughout Germany and Europe appear to be stagnating at levels seen in current months. While the growing C&I sector has actually partly balanced out the decrease in big systems and little government-subsidized systems, it has actually not yet made up for the drop. If we take a look at why the variety of PV setups is decreasing even for big roofing and ground-mounted systems, despite the fact that the circumstance ought to have enhanced and the administrative difficulties ought to have been minimized, we can see the inconsistency in between expectations and truth. It is insufficient to streamline the guidelines if there is inadequate personnel to process the flood of task applications. The time in between sending an application to the network operator and getting network approval has actually increased considerably in numerous areas rather of reducing. If the capabilities in the low- and medium-voltage network are likewise tired and extra transformers and even substations need to be constructed, a significant job can be postponed forever. And now we come to the point where business’ presence is at danger. Specifically for medium to big jobs, the preparation is frequently tremendous, and personnel and in some cases products need to be prefinanced. The danger all too frequently lies with the job designer, since banks can not do much with the present organization designs beyond the lawfully ensured compensation. They require preparing security, which is hardly ever offered, neither when developing the system nor when later offering the energy created by it. The sword of Damocles of the short-term curtailment of the photovoltaic system now hangs over whatever. If the durations of unfavorable electrical power rates continue to increase in the future, there is a threat of financial damage. The decrease in PV setups, even for big roof and ground-mounted systems, highlights a space in between expectations and truth. Streamlined guidelines are insufficient if there isn’t sufficient personnel to process the flood of job applications. In lots of areas, the time in between using to network operators and getting approval has actually increased. When low- and medium-voltage network capabilities are tired, and brand-new transformers or substations are required, tasks can deal with indefinite hold-ups. Business now deal with existential dangers. For medium to big tasks, preparing preparations are enormous, and prefinancing for personnel and products prevails. Job designers typically bear the threat since banks need preparing security, which is seldom offered throughout building or energy sales. The possibility of short-term photovoltaic system curtailment threatens more financial damage, particularly if durations of unfavorable electrical energy costs increase. The marketplace’s current quick development is now reversing, as business that broadened too rapidly battle. The PV market has actually constantly relocated waves, with booms followed by declines. The boom of 2022 and 2023 brought a rise in setups and costs, now rates are dramatically remedying, with expectations of going back to a more modest development pattern. This market combination mirrors what took place in the early 2010s. Business with excessively high expectations are collapsing, having actually stopped working to stay versatile and adjust to altering conditions. Companies should focus on versatility, buying certified workers to handle increasing market intricacy instead of going after every offer or concentrating on short-term, low-competition chances. Insolvencies are increasing throughout the photovoltaic market. Organizers and installers are battling with sluggish order inflows, financiers’ doubt, and hold-ups that trigger repaired expenses to escalate. Wholesalers are weighed down by excess stock, while competitors amongst providers– particularly throughout borders– is ending up being self-destructive. This combination wave will likely impact some manufacturers, consisting of those in China. The favorable side of market debt consolidation is that more powerful, more ingenious business will make it through. When the marketplace supports, interaction and setup quality ought to enhance. It’s time to send out favorable signals to the marketplace and the general public to enhance financial investment, bring back self-confidence in future innovations, and enhance the order circumstance. Cost points distinguished by innovation (since Oct. 15, 2024): About the author: Martin Schachinger has actually studied electrical engineering and has actually been active in the field of photovoltaics and renewable resource for practically 30 years. In 2004, he established the pvXchange.com online trading platform. The business stocks basic parts for brand-new setups and solar modules and inverters that are no longer being produced. The views and viewpoints revealed in this short article are the author’s own, and do not always show those held by pv publication. This material is safeguarded by copyright and might not be recycled. If you wish to work together with us and wish to recycle a few of our material, please contact: editors@pv-magazine.com. Popular material

- Tue. Feb 17th, 2026