A New York brief seller has actually required India to gaze at a reflection of its long-simmering disappointment with shoddy, insufficient facilities and its restless desire to fill the spaces overnight. The target of Hindenburg Research’s attack is the Adani Group, which strongly marshaled capital from all over the world into India’s unmet goals. The corporation has actually highly rejected the activist financier’s accusations of stock-price control and accounting scams. For some Indians, the loss of more than $130 billion of market price has actually come as an attack on nationalist pride. Even those who decline to relate Adani with India are required to acknowledge the bigger point of the fiasco: The nation’s cravings for better airports, larger roadways, faster rail journeys, more effective ports, more reputable power supply and cleaner air is not backed by the buying power of the masses. Dizzying equity worths may entice financial obligation into asset-owning companies for a while. Eventually, however, misallocated capital will not end the facilities deficit. BloombergWhen it pertains to carrying capital effectively, India’s stock exchange uses a lot of options. Yes, domestic cost savings are low, and just now getting released by property supervisors beyond the standard sanctuaries of gold, property and bank deposits. For immigrants prepared to take the dangers that come with emerging markets, a 30%-plus return on capital used is par for the course. Other than that these chances are normally not offered in facilities beyond telecom. Which’s where the Adani Group runs. A few of India’s more effective companies are customer multinationals that have actually been around a long period of time, such as Unilever Plc a

Learn more

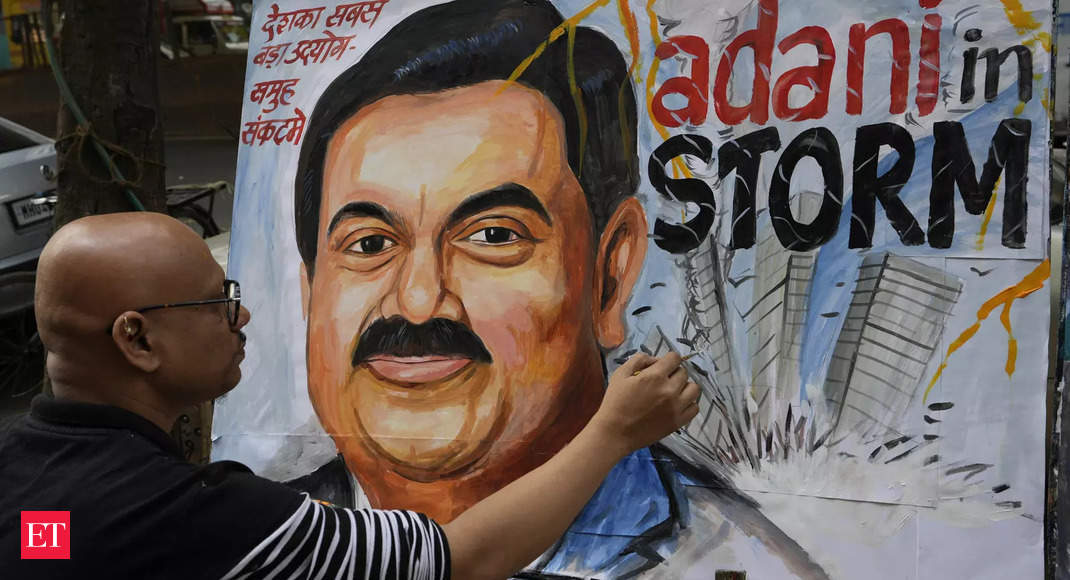

View: Adani isn’t India, But its problems mirror the country’s issues