This 20 percent plan suggests Berkshire Hathaway gains that share of IAG’s consumer premiums however likewise pays the very same level of claims. It has actually been restored early with the initial contract due to end in 2025.

“Berkshire Hathaway is a crucial partner of IAG, and we are delighted to extend our strong relationship through to the end of the years,” IAG’s primary monetary officer Michelle McPherson stated.

IAG, nevertheless, likewise exposed that a share and “tactical relationship” contract were not being restored.

It comes in the middle of market speculation that Berkshire’s relationship with IAG has actually ended up being stretched. The Sydney-based insurance provider, a significant underwriter of cars and truck and house insurance coverage whose brand names consist of NRMA and CGU, decreased to comment. Efforts to get remark from Berkshire were not successful.

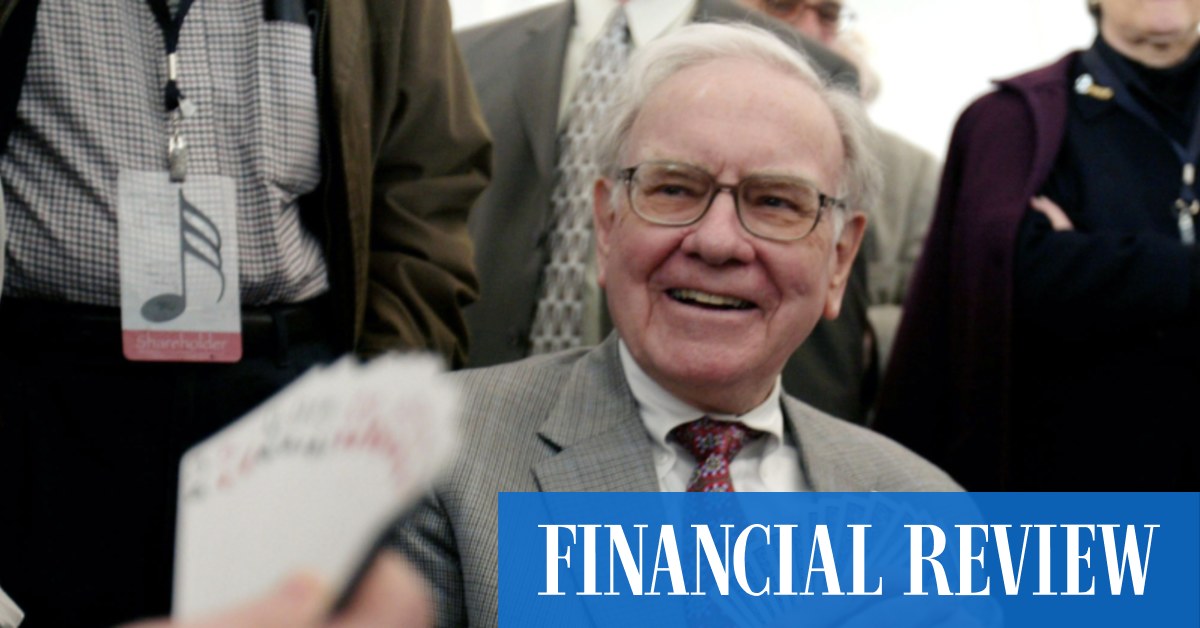

The preliminary offer consisting of Berkshire Hathaway taking a $500 million shareholding in IAG had actually been commemorated at the time. “I am 84 years of ages and this is my very first financial investment in an Australian business– I have actually been really run-down, however it has actually deserved waiting on,” Mr Buffett, nicknamed the Oracle of Omaha for his financial investment expertise, stated then.

Under that share offer, Berkshire Hathaway accepted a lock-up stipulation avoiding it offering its stake in the Australian insurance provider, while any more financial investment was topped at 14.9 percent of IAG.

The preliminary stake for $500 million in equity was acquired at $5.57 a share. Berkshire Hathaway likewise topped up its stake by getting another 9.9 million shares at $5.05 each in 2021, when IAG provided brand-new shares to support capital after a feared blowout in pandemic-related organization insurance coverage claims.

That corresponds to a 4 percent stake in IAG, however shares are now listed below the level that Berkshire Hathaway paid, trading at $4.82 in afternoon trade on Thursday.

IAG in 2015 had actually likewise kept in mind that a tactical collaboration with Berkshire had actually consisted of an “special relationship” in Australia and New Zealand. That offer has actually likewise ended, and insurance companies such as Queensland-based RACQ are on the hunt for more quota-share offers.

IAG had previously today restored other quota share handle other reinsurers, and kept on Thursday that the most recent offer was done on “a materially constant monetary result to the initial arrangement”. It would support the business’s medium-term margin target of 15 percent to 17 percent, IAG stated.

The business had likewise previously today restored its significant disaster reinsurance cover, albeit needing to pay more and likewise accepting use more expenses if a very first catastrophe strikes.