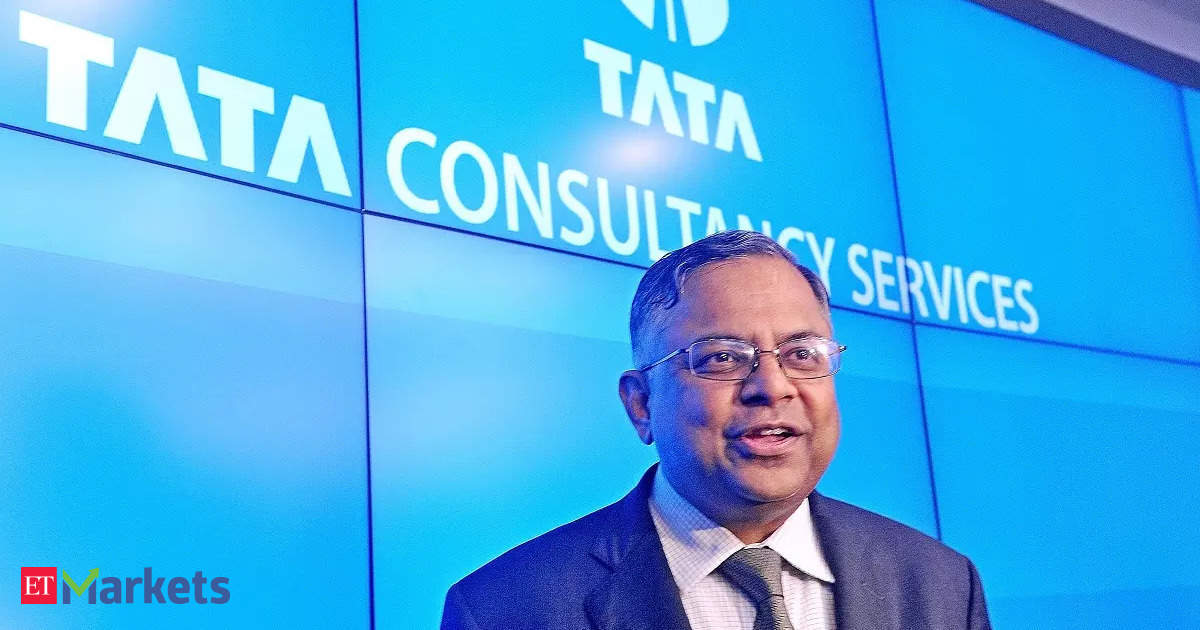

Just when the shares of Tata Consultancy Services (TCS) struck a fresh life time high of Rs 4,254.45 on BSE on Monday, financial investment lender JP Morgan provided the term sheet of a block handle which Tata Sons was seeking to offer 2.43 crore shares of the software application business. The next day, a big block offer worth around Rs 9,000 crore was reported in which Tata Sons is thought to have actually offered around 2.02 crore shares at a typical cost of Rs 4,043 per share. A last verification would be available in the night later. The effect of the promoter squandering, even if it is simply 0.6% equity sale out of 72.38% stake, was felt on the stock too. TCS shares have actually lost over 6% from their peak in simply 2 sessions. Tata Sons offers over 2 crore shares of TCS in Rs 9,000-crore block offer, stock down 3% For Tata Sons, the holding business of not simply TCS however a variety of other Tata business like Tata Power, Tata Steel, Titan, Tata Motors, Tata Chemicals and Tata Consumer, TCS is the greatest golden goose. In FY23, it made standalone income of around Rs 35,000 crore, 95% of which originated from dividends. The majority of those them were from TCS, which paid Rs 33,306 crore as dividends to investors in the last fiscal year. While the much storied salt-to-software corporation has not yet openly described the factors behind the stake sale, we note out a confluence of 4 possible factors that may have made the Tatas offer a part of their household silver. 1) Fund enthusiastic development strategies The Tata Group, under the management of Chairman N Chandrasekaran, has actually shown a pressing appetite for development in more recent locations like semiconductor and digital items. Tata Sons’ subsidiary Tata Electronics has actually dedicated t

Learn more

Why is Tata Sons milking Rs 9,000 crore from its greatest golden goose TCS? 4 possible factors