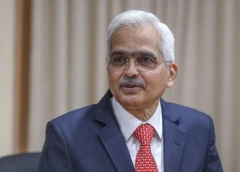

RBI Governor Shaktikanta Das (Photo: Bloomberg) The collective tightening up of financial policy by worldwide reserve banks seeking to tame inflation has actually gradually raised the threat of a difficult landing or an economic downturn, however India is positioned in a different way, Reserve Bank of India (RBI) Governor Shaktikanta Das stated. Das was speaking at the Annual Research Conference of the Department of Economic and Policy Research of the RBI in Hyderabad on Saturday. Das had actually stated previously this year that the RBI was aiming to guarantee a ‘soft landing’ for the Indian economy while bringing domestic inflation back to the reserve bank’s 4 percent target over an amount of time. The RBI guv has actually likewise stressed in current public occasions that raising rates of interest too soon would have taken a heavy toll on financial development and the residents of the nation. Most current information revealed that Consumer Price Index inflation was at 6.77 percent in October, well above the RBI’s tolerance band of 2-6 percent. The information likewise marked the 37 th month that CPI inflation was above the 4 percent target. GDP development in April-June was at 13.5 per cent, well listed below the 16.2 per cent quote that the RBI had actually made. In September, the reserve bank pegged GDP development for the present fiscal year at 7 percent, lower than its earlier price quote of 7.2 percent. While applauding the contributions of the RBI’s financial and policy research study department, particularly at the height of the Covid-19 pandemic, Das stated that the “trifecta” of deglobalisation, environment modification and much deeper penetration of innovation seemed the most awaited future pattern. “This can be possibly disruptive, needing methods to reduce the involved dangers. The effects of the 3 shocks I pointed out earlier are still unfolding and would require consistent vigil. The research study function of the Reserve Bank, for that reason, should stay ready to react to these several possibilities as it has actually carried out in the past,” he stated. The shocks that Das was describing are the Covid-19 pandemic, the Russian intrusion of Ukraine and the synchronised tightening up of financial policy around the world. “Age old research study problems for emerging market economy (EME) like external sector sustainability evaluation, practical variety of policy choices to protect sustainability, and analysis of their efficiency have as soon as again concern the leading edge, more so due to the fact that the nature and size of the spillover danger is extremely various now,” he stated. According to Das, from the point of view of the RBI, research study was presuming increased significance relative to practically every significant function and subsequently, research study systems had actually been established in other departments. The procedure of establishing research study systems requires to be continual and scaled up proactively, Das stated, mentioning that in the nation with the size and variety of India, research study on local matters benefits policy attention. Noting out focus locations, Das stated that the Department of Economic and Policy Research should internalise tactical medium-to-long term research study problems in its program. Such a procedure would help in recognizing and preserving a list of structural policy modifications that can enhance the development trajectory of the economy, he stated. Das likewise required the consistent upgradation of abilities of the economic experts working for the department in order for the RBI’s research study function to stay reliable. Secret elements Das discussed were acknowledgment of brand-new possibilities in the details age and access to remarkable computing power at low expenses. Another point the RBI Governor made was the significance of financial experts holding a PhD degree that would prepare them with all the standard abilities needed for performing research study. “An Economics Benchmark report by centralbanking.com in December 2021 after a study of 33 reserve banks discovered that usually, one in 5 economic experts in a reserve bank have a PhD,” Das stated. “I am happy to keep in mind that the Reserve Bank compares well as one in 4 economic experts in our research study department has a PhD. The Bank supplies paid leave and monetary rewards for personnel to obtain PhD degrees and I hope in future our ranking would enhance even more,” he stated. Register For Business Standard Premium Exclusive Stories, Curated Newsletters, 26 years of Archives, E-paper, and more! Released: Sat, November 192022 15: 16 IST

Read More

Danger of worldwide tough landing, however India in a different way put: Shaktikanta Das – Business Standard