BANGALORE/TOKYO (Reuters) – SoftBank Group Corp (9984 T) creator Masayoshi Boy’s imagine an international tech empire is deciphering, with the coronavirus crisis intensifying losses at his $100 billion Vision Fund and distress at his big bets hinting more pain.

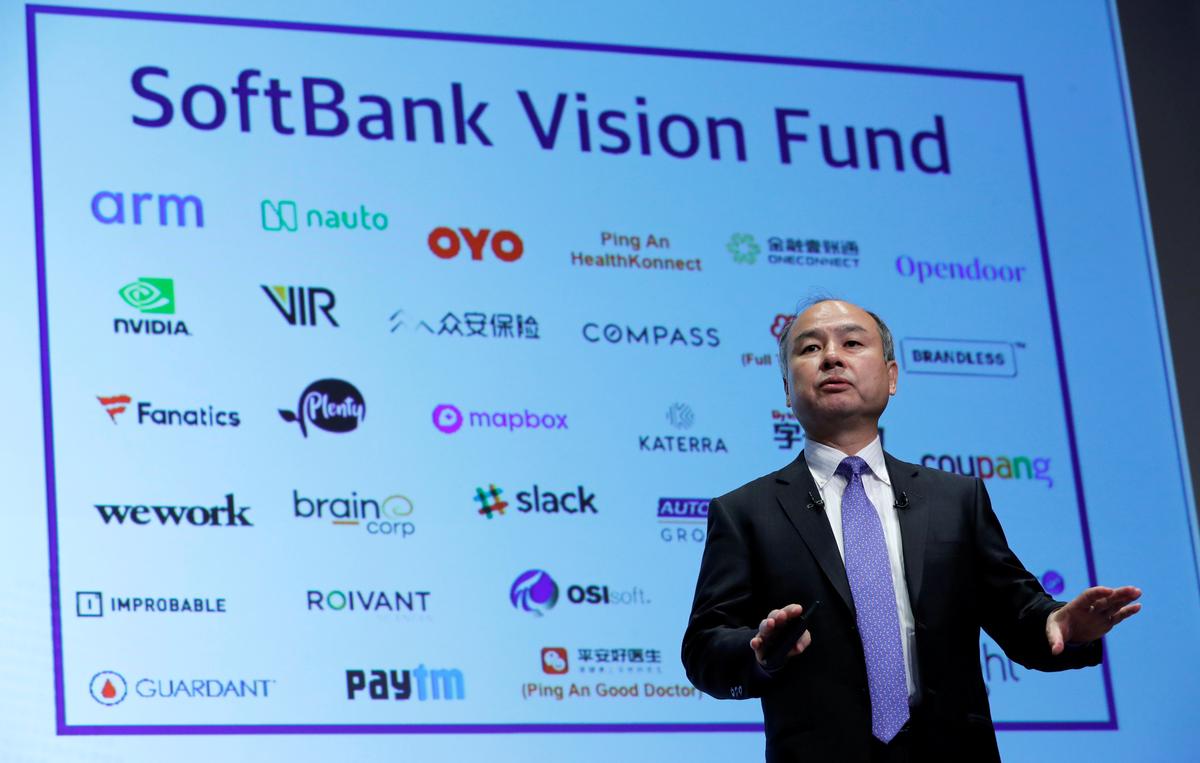

FILE IMAGE: Japan’s SoftBank Group Corp Chief Executive Masayoshi Boy goes to a news conference in Tokyo, Japan, November 5,2018 REUTERS/Kim Kyung-Hoon/File Photo

More than half of the fund’s capital is in start-ups that are struggling with the infection impact or displaying stress pre-dating the outbreak, a Reuters analysis showed. Ride-hailing use at flagship transportation investments has actually fallen more than 50%and 6 SoftBank-backed start-ups have pushed IPO plans from this year to next.

The Japanese conglomerate has already flagged a 1.8 trillion yen ($17 billion) loss at the fund for the year to March – during which Child’s “instinctive” bet WeWork marvelously imploded – unsettling Middle Eastern backers which puzzled up much of the fund’s money.

Though numerous problems at portfolio firms pre-date the pandemic, the resulting financial disaster has actually exposed what critics have actually long called an extraordinarily risky strategy of tilling big amounts into unproven businesses in the expectation that would enable them to control big brand-new markets.

” The Vision Fund has actually been a mess. It has been a case of an organisation with too much cash just splashing it around without doing enough due diligence,” stated Joe Bauernfreund, chief executive of SoftBank investor Possession Value Investors.

Kid changed SoftBank into a tech financier over the previous three years and raised the world’s biggest late-stage mutual fund in the Vision Fund. To be sure, some investments are doing much better, but examples are scant as the pandemic magnifies problems.

The discomfort is especially keen in transport and real estate, that make up $43 billion of financial investment and consist of car-share firm Getaround, home-seller OpenDoor and property brokerage Compass.

Constraints on motion worldwide has hit the ma